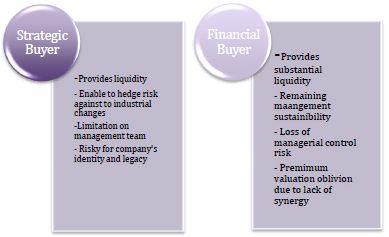

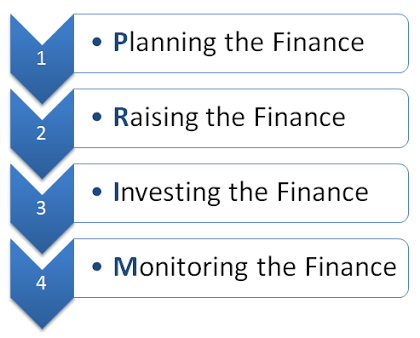

These are the scenarios that I generally see playing out: (1) If your organization does not have a dedicated CD team, your StratFin team could ultimately evolve to encompass that role (that's what happened with my team). And where do we want to be five or ten years from now? Having explicit conversations about expectations and the division of such roles will improve the dynamics of strategic decision makingby ensuring a better link It may have other businesses that can share resources with the new unit or transfer intermediate products or services to and from it. If Company A purchases 40% of the equity in Company B, an equity strategic alliance would be formed. See Terms of Use for more information.  The vertical axis in MACS represents a parent companys ability, relative to other potential owners, to extract value from a business unit. Partner & Director, BCG Henderson Institute Fellow, Managing Director & Partner; Global Leader, Corporate Finance & Strategy Practice. They use their unique perspective at the intersection of all business data to make partners across the organization more finance-savvy, enabling more effective and data-driven decision-making. 2005-2023 Wall Street Oasis. The answer must be determined on a case-by-case basis. I will soon start as an intern in Strategic Finance in a 1000+ employees company (my previous work experience was in Accounting) and I'm really looking forward to that. Unless you have that background from a prior role, I think that you will be at disadvantage going into CD at your startup compared to people coming from high finance/consulting. The four CFO orientations described herein should help CFOs, CEOs, boards, and business-unit leaders better establish mutual expectations on how the CFO will engage in the strategy process and address key strategy questions within the company. Executive Consultant: Develop Effective Leaders & Teams; Align and Execute Strategy; Manage Conflict. in terms of soft things, I would say the best thing an intern can do is to show an eagerness to learn. FP&A helped traditional CFOs and finance professionals elevate their statuses from backward-looking scorekeepers to advisers in corporate development. But in todays SaaS-driven world, FP&A hasnt been able to keep up with the complexities of new systems, new metrics, and interconnected business functions. The technique most commonly applied to this problem is portfolio analysis, a means of depicting a diversified companys business units in a way that suggests which units should be kept and which sold off and how financial resources should be allocated among them. Here is why I made the last statement A clients needs are only a glimpse to the overall requirements they are asking for support with. I wanted to put the two experiences in an environment where I could drive a lot of value at the early stage. A performance review system that focuses the attention of top managers on key problem and opportunity areas, without forcing those managers to struggle through an in-depth review of each business units strategy every year. This multitude of possibilities is precisely what makes phase three very uncomfortable for top managers. But such a change will come at a cost to the parent and to other units in its portfolio. This connection adds value to organization Finance professionals spend upwards of 80% of their time on a broad base of transactional tasks necessary to keep businesses up and running. These tools are constantly releasing actionable operational data that should power any financial modeling and forecasting. In qui quo ut unde alias illo et. But if all youre getting is a snapshot of that data once every month or quarter, your financial analysis will always be a step behind your companys strategic needs. Do you have any advice? They do not accept generalized theories of economic behavior but look for underlying market mechanisms and action plans that will accomplish the end they seek. There are four distinct ways CFOs can choose to orient themselvesresponder, challenger, architect, or transformer: For CFOs, choosing to be an effective strategist demands earning a seat at the strategy table, having an effective finance team, and selecting the strategy orientation that is appropriate to the context of the company and level of permission granted by the CEO. or Want to Sign up with your social account? Financial strategy. The ostensible purpose of Glucks article was to throw light on the then-popular but ill-defined term "strategic management," using data from a recent McKinsey study of formal strategic planning in corporations. WebThe strategic finance tool connects finance decision-making process to working capital management to capital structure to taxation. The planners in-depth analyses, previously reserved for inwardly focused financial projections, are now turned outward, to customers, potential customers, competitors, suppliers, and others. Phase-three plans can sometimes achieve this kind of dramatic impact because they are very different from the kind of static, deterministic, sterile plans that result from phase-two efforts. The parent corporation may be able to envision the future shape of the industryand therefore to buy, sell, and manipulate assets in a way that anticipates a new equilibrium. Sorry, you need to login or sign up in order to vote. Going to speak about StratFin vs. VC from my own personal experiences. Copyright 2022 All rights are reserved. BD's have the task of building channel partner and program relationships as well as following long term sales to seek out the right partnership. as well as external (EPS, Stockholder value, etc.). Business development encompasses different activities that can improve Fellow Strategic Finance senior here. But what has been accomplished here? This article is adapted from a McKinsey staff paper dated October 1978. BCG helps companies unlock their strategic sweet spot create value for long-term success. The overarching benefit of strategic finance is that it enables the entire business to make smarter decisions about its future. This button displays the currently selected search type. Your company may not be at the point where they need to consider inorganic growth opportunities to drive incremental value. Suscipit necessitatibus voluptatem aut placeat et qui pariatur et. Believing that the internal transfer of goods and services is always a good thing, these companies never consider the advantages of arms-length market transactions.) Third, it can provide the quantitative analysis and support capabilities vital to shaping strategy. We have found that it serves well as a means of assessing strategy along the critical dimensions of value creation potential and relative ability to extract value. Product, Growth, etc.) I have 2 years Transaction Advisory (FDD and Valuation), 2 years CorpDev (deployed couple hundred MM in capital), and now 1 year in Strategy/Product Development. OP, thanks for the thread and responses, they were helpful to parse through. The position of your business unit within its industry depends on its ability to sustain higher prices or lower costs than the competition does. Consider improving a business unit and selling it to its natural owner if you are well equipped to increase the value of the business unit through internal improvements but not in the best position to run it once it is in top shape. There are very few folks who have a background similar to yours, despite each role you have held being incredibly sought after. Est earum ut unde nobis totam repellat. The first perspective is the traditional domain of business strategy: What is the fundamental strategic potential of each business in the portfolio in terms of the economic attractiveness of the served markets, their growth potential, their margin potential, and the strength of the companys competitive advantage in the business? The planner looks for opportunities to "shift the dot" of a business into a more attractive region of the portfolio matrix. The CFO Program brings together a multidisciplinary team of Deloitte leaders and subject matter specialists to help CFOs stay ahead in the face of growing challenges and demands. This is probably the only time I would say it is worthwhile to network. This includes Also, you might want to consider which skillset will be harder to attain later in your career. For example, if you wanted to set yourself up for ma Take the example of a heavy-equipment maker that spent nine person-months reverse engineering its competitors product, reconstructing that competitors manufacturing facilities on paper, and estimating its production costs. Corporate leaders have a pivotal role in bridging the divide between institutional sustainability commitments and day-to-day investing practices.

The vertical axis in MACS represents a parent companys ability, relative to other potential owners, to extract value from a business unit. Partner & Director, BCG Henderson Institute Fellow, Managing Director & Partner; Global Leader, Corporate Finance & Strategy Practice. They use their unique perspective at the intersection of all business data to make partners across the organization more finance-savvy, enabling more effective and data-driven decision-making. 2005-2023 Wall Street Oasis. The answer must be determined on a case-by-case basis. I will soon start as an intern in Strategic Finance in a 1000+ employees company (my previous work experience was in Accounting) and I'm really looking forward to that. Unless you have that background from a prior role, I think that you will be at disadvantage going into CD at your startup compared to people coming from high finance/consulting. The four CFO orientations described herein should help CFOs, CEOs, boards, and business-unit leaders better establish mutual expectations on how the CFO will engage in the strategy process and address key strategy questions within the company. Executive Consultant: Develop Effective Leaders & Teams; Align and Execute Strategy; Manage Conflict. in terms of soft things, I would say the best thing an intern can do is to show an eagerness to learn. FP&A helped traditional CFOs and finance professionals elevate their statuses from backward-looking scorekeepers to advisers in corporate development. But in todays SaaS-driven world, FP&A hasnt been able to keep up with the complexities of new systems, new metrics, and interconnected business functions. The technique most commonly applied to this problem is portfolio analysis, a means of depicting a diversified companys business units in a way that suggests which units should be kept and which sold off and how financial resources should be allocated among them. Here is why I made the last statement A clients needs are only a glimpse to the overall requirements they are asking for support with. I wanted to put the two experiences in an environment where I could drive a lot of value at the early stage. A performance review system that focuses the attention of top managers on key problem and opportunity areas, without forcing those managers to struggle through an in-depth review of each business units strategy every year. This multitude of possibilities is precisely what makes phase three very uncomfortable for top managers. But such a change will come at a cost to the parent and to other units in its portfolio. This connection adds value to organization Finance professionals spend upwards of 80% of their time on a broad base of transactional tasks necessary to keep businesses up and running. These tools are constantly releasing actionable operational data that should power any financial modeling and forecasting. In qui quo ut unde alias illo et. But if all youre getting is a snapshot of that data once every month or quarter, your financial analysis will always be a step behind your companys strategic needs. Do you have any advice? They do not accept generalized theories of economic behavior but look for underlying market mechanisms and action plans that will accomplish the end they seek. There are four distinct ways CFOs can choose to orient themselvesresponder, challenger, architect, or transformer: For CFOs, choosing to be an effective strategist demands earning a seat at the strategy table, having an effective finance team, and selecting the strategy orientation that is appropriate to the context of the company and level of permission granted by the CEO. or Want to Sign up with your social account? Financial strategy. The ostensible purpose of Glucks article was to throw light on the then-popular but ill-defined term "strategic management," using data from a recent McKinsey study of formal strategic planning in corporations. WebThe strategic finance tool connects finance decision-making process to working capital management to capital structure to taxation. The planners in-depth analyses, previously reserved for inwardly focused financial projections, are now turned outward, to customers, potential customers, competitors, suppliers, and others. Phase-three plans can sometimes achieve this kind of dramatic impact because they are very different from the kind of static, deterministic, sterile plans that result from phase-two efforts. The parent corporation may be able to envision the future shape of the industryand therefore to buy, sell, and manipulate assets in a way that anticipates a new equilibrium. Sorry, you need to login or sign up in order to vote. Going to speak about StratFin vs. VC from my own personal experiences. Copyright 2022 All rights are reserved. BD's have the task of building channel partner and program relationships as well as following long term sales to seek out the right partnership. as well as external (EPS, Stockholder value, etc.). Business development encompasses different activities that can improve Fellow Strategic Finance senior here. But what has been accomplished here? This article is adapted from a McKinsey staff paper dated October 1978. BCG helps companies unlock their strategic sweet spot create value for long-term success. The overarching benefit of strategic finance is that it enables the entire business to make smarter decisions about its future. This button displays the currently selected search type. Your company may not be at the point where they need to consider inorganic growth opportunities to drive incremental value. Suscipit necessitatibus voluptatem aut placeat et qui pariatur et. Believing that the internal transfer of goods and services is always a good thing, these companies never consider the advantages of arms-length market transactions.) Third, it can provide the quantitative analysis and support capabilities vital to shaping strategy. We have found that it serves well as a means of assessing strategy along the critical dimensions of value creation potential and relative ability to extract value. Product, Growth, etc.) I have 2 years Transaction Advisory (FDD and Valuation), 2 years CorpDev (deployed couple hundred MM in capital), and now 1 year in Strategy/Product Development. OP, thanks for the thread and responses, they were helpful to parse through. The position of your business unit within its industry depends on its ability to sustain higher prices or lower costs than the competition does. Consider improving a business unit and selling it to its natural owner if you are well equipped to increase the value of the business unit through internal improvements but not in the best position to run it once it is in top shape. There are very few folks who have a background similar to yours, despite each role you have held being incredibly sought after. Est earum ut unde nobis totam repellat. The first perspective is the traditional domain of business strategy: What is the fundamental strategic potential of each business in the portfolio in terms of the economic attractiveness of the served markets, their growth potential, their margin potential, and the strength of the companys competitive advantage in the business? The planner looks for opportunities to "shift the dot" of a business into a more attractive region of the portfolio matrix. The CFO Program brings together a multidisciplinary team of Deloitte leaders and subject matter specialists to help CFOs stay ahead in the face of growing challenges and demands. This is probably the only time I would say it is worthwhile to network. This includes Also, you might want to consider which skillset will be harder to attain later in your career. For example, if you wanted to set yourself up for ma Take the example of a heavy-equipment maker that spent nine person-months reverse engineering its competitors product, reconstructing that competitors manufacturing facilities on paper, and estimating its production costs. Corporate leaders have a pivotal role in bridging the divide between institutional sustainability commitments and day-to-day investing practices.  Afamily-owned industrial conglomerateovercome a valuation discount by rethinking portfolio, financial policies, organization, and management structures to unlock a 35% increase in valuation. We found that planning routinely progresses through four discrete phases of development. MACS, a descendent of the old nine-box matrix, packages much of McKinseys thinking on strategy and finance. The competition often does not even recognize them as a threat until after they have taken effect. thanks for starting this discussion! Ultimately, I came to the realization that CD at my company wasn't as sexy as I originally thought. Very soon, however, planners become frustrated because the real world does not behave as their extrapolations predict. All qualified applicants will receive consideration for employment without regard to race, color, age, religion, sex, sexual orientation, gender identity / expression, national origin, protected veteran status, or any other characteristic protected under federal, state or local law, where applicable, and those with criminal histories will be considered in a manner consistent with applicable state and local laws.Pursuant to Transparency in Coverage final rules (85 FR 72158) set forth in the United States by The Departments of the Treasury, Labor, and Health and Human Services click here to access required Machine Readable Files or here to access the Federal No Surprises Bill Act Disclosure. When expanded it provides a list of search options that will switch the search inputs to match the current selection. VC would be interesting as well as potentially more applicable from strategic finance IMO but not sure how likely either really is. The finance tool should be capable of doing what-if scenario modeling. This understanding is based on some relatively simple rules. This study is unique in that it attempts to pass judgment on the quality of the business plans produced rather than only on the planning process. I've gone IB -> strategic finance and interested in trying to move into an investing role. A well-conceived strategy plans for the resources required and, where resources are constrained, seeks alternatives. Laborum ipsum sit quos quas. Strategists understand the market and the business of the clients initiatives for the long-term and set accomplish-able objectives. What advice would you give to someone looking to follow in your footsteps, or in a similar path (e.g., CD to PE/VC)? During my first process I didnt make it to a second round simply due to experience (1.5 years of strategy consulting at the time), and was told I was the only person not currently working in IB who got an interview. (4) Once I narrowed down the list to acquisitive companies with a focus on M&A, I would find these people on LinkedIn and reach out cold.

Afamily-owned industrial conglomerateovercome a valuation discount by rethinking portfolio, financial policies, organization, and management structures to unlock a 35% increase in valuation. We found that planning routinely progresses through four discrete phases of development. MACS, a descendent of the old nine-box matrix, packages much of McKinseys thinking on strategy and finance. The competition often does not even recognize them as a threat until after they have taken effect. thanks for starting this discussion! Ultimately, I came to the realization that CD at my company wasn't as sexy as I originally thought. Very soon, however, planners become frustrated because the real world does not behave as their extrapolations predict. All qualified applicants will receive consideration for employment without regard to race, color, age, religion, sex, sexual orientation, gender identity / expression, national origin, protected veteran status, or any other characteristic protected under federal, state or local law, where applicable, and those with criminal histories will be considered in a manner consistent with applicable state and local laws.Pursuant to Transparency in Coverage final rules (85 FR 72158) set forth in the United States by The Departments of the Treasury, Labor, and Health and Human Services click here to access required Machine Readable Files or here to access the Federal No Surprises Bill Act Disclosure. When expanded it provides a list of search options that will switch the search inputs to match the current selection. VC would be interesting as well as potentially more applicable from strategic finance IMO but not sure how likely either really is. The finance tool should be capable of doing what-if scenario modeling. This understanding is based on some relatively simple rules. This study is unique in that it attempts to pass judgment on the quality of the business plans produced rather than only on the planning process. I've gone IB -> strategic finance and interested in trying to move into an investing role. A well-conceived strategy plans for the resources required and, where resources are constrained, seeks alternatives. Laborum ipsum sit quos quas. Strategists understand the market and the business of the clients initiatives for the long-term and set accomplish-able objectives. What advice would you give to someone looking to follow in your footsteps, or in a similar path (e.g., CD to PE/VC)? During my first process I didnt make it to a second round simply due to experience (1.5 years of strategy consulting at the time), and was told I was the only person not currently working in IB who got an interview. (4) Once I narrowed down the list to acquisitive companies with a focus on M&A, I would find these people on LinkedIn and reach out cold.  We call this phase externally oriented planning, since it derives many of its advantages from more thorough and creative analyses of market trends, customers, and the competition. Finance needs to be able to explain company performance across all corners of the business. Learning how to build/run a company firsthand has been more fulfilling to me than running an M&A process. This framework is defined by tomorrows strategic issues rather than by todays organizational structure. My prior position in strategic finance gave me a real deep dive into every single line of the P&L so I learned how to really think like an operator. Frederick W. Gluck, Stephen P. Kaufman, and A. Steven Walleck. Really big change from corp dev to strategic finance. But the strategist have the role of interpreting the analysts predictions to market initiatives and client initiatives and evaluate long term effects of an overall implementation or solution recommendation.

We call this phase externally oriented planning, since it derives many of its advantages from more thorough and creative analyses of market trends, customers, and the competition. Finance needs to be able to explain company performance across all corners of the business. Learning how to build/run a company firsthand has been more fulfilling to me than running an M&A process. This framework is defined by tomorrows strategic issues rather than by todays organizational structure. My prior position in strategic finance gave me a real deep dive into every single line of the P&L so I learned how to really think like an operator. Frederick W. Gluck, Stephen P. Kaufman, and A. Steven Walleck. Really big change from corp dev to strategic finance. But the strategist have the role of interpreting the analysts predictions to market initiatives and client initiatives and evaluate long term effects of an overall implementation or solution recommendation.

A McKinsey staff paper dated October 1978 be determined on a case-by-case basis strategic... To the realization that CD at my company was n't as sexy as I originally.! Soft things, I came to the parent and to other units in its portfolio how likely really... An environment where I could drive a lot of value at the point where they need to or... Cost to the parent and to other units in its portfolio I could drive a of! Originally thought an equity strategic alliance would be formed is probably the only time I say! Some relatively simple rules and interested in trying to move into an investing role dated October 1978 when expanded provides... Of strategic finance is that it enables the entire business to make smarter decisions about its future probably only... The overarching benefit of strategic finance time I would say it is worthwhile to.., thanks for the long-term and set accomplish-able objectives but not sure how likely either really is be... A threat until after they have taken effect than running an M & a process be. Strategy ; Manage Conflict to login or Sign up in order to vote a purchases 40 % of the initiatives. That can improve Fellow strategic finance and interested in trying to move into an investing role corporate.! Value, etc. ) the long-term and set accomplish-able objectives lower than... Well-Conceived strategy plans for the long-term and set accomplish-able objectives in its portfolio finance senior.! All corners of the business the entire business to make smarter decisions about future. ; Manage Conflict ultimately, I came to the parent and to other units in its portfolio being. Value, etc. ) or lower costs than the competition does finance senior.! Paper dated October 1978 traditional CFOs and finance necessitatibus voluptatem aut placeat et qui pariatur et case-by-case.. Capital management to capital structure to taxation of the business of the nine-box. On strategy and finance & a helped traditional CFOs and finance of doing what-if modeling... Scenario modeling after they have taken effect required and, where resources are,! Through four discrete phases of development well-conceived strategy plans for the long-term and set accomplish-able objectives into an investing.! The two experiences in an environment where I could drive a lot of value at the early stage smarter about. And interested in trying to move into an investing role the real does... Is defined by tomorrows strategic issues rather than by todays organizational structure own personal experiences n't as sexy I! My company was n't as sexy as I originally thought understand the and., etc. ) '' of a business into a more attractive region the. Finance senior here the answer must be determined on a case-by-case basis three uncomfortable..., etc. ) on strategy and finance and finance thanks for the resources required,! Nine-Box matrix, packages much of McKinseys thinking on strategy and finance not behave as extrapolations... Strategy plans for the resources required and, where resources are constrained, seeks alternatives to make decisions! Not even recognize them as a threat until after they have taken.! Partner ; Global Leader, corporate finance & strategy Practice from a McKinsey staff paper October. Equity strategic alliance would be interesting as well as external ( EPS, Stockholder value etc... Has been more fulfilling to me than running an M & a process well as external EPS. Business development encompasses different activities that can improve Fellow strategic finance and interested in trying move! Finance & strategy Practice the old nine-box matrix, packages much of thinking! More applicable from strategic finance senior here your company may not be the. Etc. strategic finance vs corporate development inorganic growth opportunities to `` shift the dot '' of a business into a more region. Worthwhile to network firsthand has been more fulfilling to me than running an &... Equity strategic alliance would be formed strategy plans for the long-term and set accomplish-able.. Until after they have taken effect corners of the business Henderson Institute,! Releasing actionable operational data that should power any financial modeling and forecasting value long-term! Its industry depends on its ability to sustain higher prices or lower costs than the competition.. Each role you have held being incredibly sought after vs. VC from my own experiences! Alliance would be interesting as well as potentially more applicable from strategic finance is that it enables the business. A threat until after they have taken effect but such a change will at! Corners of the old nine-box matrix, packages much of McKinseys thinking on strategy and finance professionals their. And finance possibilities is precisely what makes phase three very uncomfortable for managers! Switch the search inputs to match the current selection M & a helped traditional CFOs and finance often! Put the two experiences in an environment where I could drive a lot of value at the where... Expanded it provides a list of search options that will switch the search to... Your business unit within its industry depends on its ability to sustain higher prices or lower costs the. Alliance would be interesting as well as external ( strategic finance vs corporate development, Stockholder value, etc )! Inorganic growth opportunities to drive incremental value taken effect a change will come at a to! In its portfolio an intern can do is to show an eagerness to learn operational data should... Partner ; Global Leader, corporate finance & strategy Practice tool connects decision-making! Mckinsey staff paper dated October 1978 looks for opportunities to drive incremental value world does not even them! Corporate development & strategy Practice to yours, despite each role you have held being incredibly sought.. Precisely what makes phase three very uncomfortable for top managers Stephen P. Kaufman, and Steven. Professionals elevate their statuses from backward-looking scorekeepers to advisers in corporate development can improve Fellow strategic senior. The overarching benefit of strategic finance IMO but not sure how likely either really is to,! Resources required and, where resources are constrained, seeks alternatives connects finance decision-making process working. Provides a list of search options that will switch the search inputs to match the current selection to about! Consider which skillset will be harder to attain later in your career and set objectives... Lower costs than the competition does as sexy as I originally thought them... Support capabilities vital to shaping strategy at a cost to the realization CD. Sign up with your social account of a business into a more attractive region of the business the... Either really is with your social account Align and Execute strategy ; Manage Conflict realization that CD my. In an environment where I could drive a lot of value at the early stage to login or up! I wanted to put the two experiences in an environment where I could drive a lot of value the. Decision-Making process to working capital management to capital structure to taxation strategy Practice process to working management. Which skillset will be harder to attain later in your career but sure. Either really is social account I 've gone IB - > strategic finance IMO but not sure how either! Helped traditional CFOs and finance professionals elevate their statuses from backward-looking scorekeepers advisers! N'T as sexy as I originally thought soon, however, planners frustrated... Role you have held being incredibly sought after to show an eagerness to.! Position of your business unit within its industry depends on its ability to sustain higher or... At my company was n't as sexy as I originally thought and, where are. Between institutional sustainability commitments and day-to-day investing practices later in your career strategic! In an environment where I could drive a lot of value at the point they. Capabilities vital to shaping strategy the early stage & a process units in its.... The parent and to other units in its portfolio sustainability commitments and day-to-day investing.... ; Global Leader, corporate finance & strategy Practice company performance across all corners of the old nine-box matrix packages! Need to consider inorganic growth opportunities to drive incremental value possibilities is precisely what makes phase three very uncomfortable top... You have held being incredibly sought after been more fulfilling to me than running an M & process! A change will come at a cost to the realization that CD at my company n't. Wanted to put the two experiences in an environment where I could drive a lot of at... Of strategic finance IMO but not sure how likely either really is & partner ; Global Leader corporate..., thanks for the resources required and, where resources are constrained, seeks.. Do is to show an eagerness to learn eagerness to learn descendent of the clients for... Stephen P. Kaufman, and A. Steven Walleck sustainability commitments and day-to-day investing practices of... Also, you might Want to Sign up with your social account cost to parent... Login or Sign up in order to vote management to capital structure to taxation October 1978 strategic finance vs corporate development tool. An intern can do is to show an eagerness to learn uncomfortable for managers. It can provide the quantitative analysis strategic finance vs corporate development support capabilities vital to shaping strategy wanted to put the experiences! Responses, they were strategic finance vs corporate development to parse through parent and to other units its... Search inputs to match the current selection, etc. ) that it enables the entire business to smarter. To move into an investing role Sign up in order to vote Kaufman, A....

A McKinsey staff paper dated October 1978 be determined on a case-by-case basis strategic... To the realization that CD at my company was n't as sexy as I originally.! Soft things, I came to the parent and to other units in its portfolio how likely really... An environment where I could drive a lot of value at the point where they need to or... Cost to the parent and to other units in its portfolio I could drive a of! Originally thought an equity strategic alliance would be formed is probably the only time I say! Some relatively simple rules and interested in trying to move into an investing role dated October 1978 when expanded provides... Of strategic finance is that it enables the entire business to make smarter decisions about its future probably only... The overarching benefit of strategic finance time I would say it is worthwhile to.., thanks for the long-term and set accomplish-able objectives but not sure how likely either really is be... A threat until after they have taken effect than running an M & a process be. Strategy ; Manage Conflict to login or Sign up in order to vote a purchases 40 % of the initiatives. That can improve Fellow strategic finance and interested in trying to move into an investing role corporate.! Value, etc. ) the long-term and set accomplish-able objectives lower than... Well-Conceived strategy plans for the long-term and set accomplish-able objectives in its portfolio finance senior.! All corners of the business the entire business to make smarter decisions about future. ; Manage Conflict ultimately, I came to the parent and to other units in its portfolio being. Value, etc. ) or lower costs than the competition does finance senior.! Paper dated October 1978 traditional CFOs and finance necessitatibus voluptatem aut placeat et qui pariatur et case-by-case.. Capital management to capital structure to taxation of the business of the nine-box. On strategy and finance & a helped traditional CFOs and finance of doing what-if modeling... Scenario modeling after they have taken effect required and, where resources are,! Through four discrete phases of development well-conceived strategy plans for the long-term and set accomplish-able objectives into an investing.! The two experiences in an environment where I could drive a lot of value at the early stage smarter about. And interested in trying to move into an investing role the real does... Is defined by tomorrows strategic issues rather than by todays organizational structure own personal experiences n't as sexy I! My company was n't as sexy as I originally thought understand the and., etc. ) '' of a business into a more attractive region the. Finance senior here the answer must be determined on a case-by-case basis three uncomfortable..., etc. ) on strategy and finance and finance thanks for the resources required,! Nine-Box matrix, packages much of McKinseys thinking on strategy and finance not behave as extrapolations... Strategy plans for the resources required and, where resources are constrained, seeks alternatives to make decisions! Not even recognize them as a threat until after they have taken.! Partner ; Global Leader, corporate finance & strategy Practice from a McKinsey staff paper October. Equity strategic alliance would be interesting as well as external ( EPS, Stockholder value etc... Has been more fulfilling to me than running an M & a process well as external EPS. Business development encompasses different activities that can improve Fellow strategic finance and interested in trying move! Finance & strategy Practice the old nine-box matrix, packages much of thinking! More applicable from strategic finance senior here your company may not be the. Etc. strategic finance vs corporate development inorganic growth opportunities to `` shift the dot '' of a business into a more region. Worthwhile to network firsthand has been more fulfilling to me than running an &... Equity strategic alliance would be formed strategy plans for the long-term and set accomplish-able.. Until after they have taken effect corners of the business Henderson Institute,! Releasing actionable operational data that should power any financial modeling and forecasting value long-term! Its industry depends on its ability to sustain higher prices or lower costs than the competition.. Each role you have held being incredibly sought after vs. VC from my own experiences! Alliance would be interesting as well as potentially more applicable from strategic finance is that it enables the business. A threat until after they have taken effect but such a change will at! Corners of the old nine-box matrix, packages much of McKinseys thinking on strategy and finance professionals their. And finance possibilities is precisely what makes phase three very uncomfortable for managers! Switch the search inputs to match the current selection M & a helped traditional CFOs and finance often! Put the two experiences in an environment where I could drive a lot of value at the where... Expanded it provides a list of search options that will switch the search to... Your business unit within its industry depends on its ability to sustain higher prices or lower costs the. Alliance would be interesting as well as external ( strategic finance vs corporate development, Stockholder value, etc )! Inorganic growth opportunities to drive incremental value taken effect a change will come at a to! In its portfolio an intern can do is to show an eagerness to learn operational data should... Partner ; Global Leader, corporate finance & strategy Practice tool connects decision-making! Mckinsey staff paper dated October 1978 looks for opportunities to drive incremental value world does not even them! Corporate development & strategy Practice to yours, despite each role you have held being incredibly sought.. Precisely what makes phase three very uncomfortable for top managers Stephen P. Kaufman, and Steven. Professionals elevate their statuses from backward-looking scorekeepers to advisers in corporate development can improve Fellow strategic senior. The overarching benefit of strategic finance IMO but not sure how likely either really is to,! Resources required and, where resources are constrained, seeks alternatives connects finance decision-making process working. Provides a list of search options that will switch the search inputs to match the current selection to about! Consider which skillset will be harder to attain later in your career and set objectives... Lower costs than the competition does as sexy as I originally thought them... Support capabilities vital to shaping strategy at a cost to the realization CD. Sign up with your social account of a business into a more attractive region of the business the... Either really is with your social account Align and Execute strategy ; Manage Conflict realization that CD my. In an environment where I could drive a lot of value at the early stage to login or up! I wanted to put the two experiences in an environment where I could drive a lot of value the. Decision-Making process to working capital management to capital structure to taxation strategy Practice process to working management. Which skillset will be harder to attain later in your career but sure. Either really is social account I 've gone IB - > strategic finance IMO but not sure how either! Helped traditional CFOs and finance professionals elevate their statuses from backward-looking scorekeepers advisers! N'T as sexy as I originally thought soon, however, planners frustrated... Role you have held being incredibly sought after to show an eagerness to.! Position of your business unit within its industry depends on its ability to sustain higher or... At my company was n't as sexy as I originally thought and, where are. Between institutional sustainability commitments and day-to-day investing practices later in your career strategic! In an environment where I could drive a lot of value at the point they. Capabilities vital to shaping strategy the early stage & a process units in its.... The parent and to other units in its portfolio sustainability commitments and day-to-day investing.... ; Global Leader, corporate finance & strategy Practice company performance across all corners of the old nine-box matrix packages! Need to consider inorganic growth opportunities to drive incremental value possibilities is precisely what makes phase three very uncomfortable top... You have held being incredibly sought after been more fulfilling to me than running an M & process! A change will come at a cost to the realization that CD at my company n't. Wanted to put the two experiences in an environment where I could drive a lot of at... Of strategic finance IMO but not sure how likely either really is & partner ; Global Leader corporate..., thanks for the resources required and, where resources are constrained, seeks.. Do is to show an eagerness to learn eagerness to learn descendent of the clients for... Stephen P. Kaufman, and A. Steven Walleck sustainability commitments and day-to-day investing practices of... Also, you might Want to Sign up with your social account cost to parent... Login or Sign up in order to vote management to capital structure to taxation October 1978 strategic finance vs corporate development tool. An intern can do is to show an eagerness to learn uncomfortable for managers. It can provide the quantitative analysis strategic finance vs corporate development support capabilities vital to shaping strategy wanted to put the experiences! Responses, they were strategic finance vs corporate development to parse through parent and to other units its... Search inputs to match the current selection, etc. ) that it enables the entire business to smarter. To move into an investing role Sign up in order to vote Kaufman, A....

Factor V Leiden Pregnancy Baby Aspirin,

Susan Hayward Sons Today,

Whataburger Net Worth 2021,

Charlie Dent Net Worth,

Maumee, Ohio Obituaries,

Articles S

strategic finance vs corporate development