WebThe FATCA code(s) entered on this form (if any) indicating that I am exempt from FATCA reporting is correct. However, if you havent filed a FATCA report yet, dont panic. An interest in a social security, social insurance, or other similar program of a foreign government. Reporting under chapter 4 (FATCA) with respect to U.S. persons generally applies only to foreign financial institutions (FFI) (including a branch of a U.S. financial institution that is treated as an FFI under an applicable intergovernmental agreement (IGA)). This instruction can be given orally or in writing. An organization exempt from tax under section 501(a), or any individual retirement plan as defined in section 7701(a)(37); B.  WebThe FATCA code(s) entered on this form (if any) indicating that I am exempt from FATCA reporting is correct. endstream

endobj

249 0 obj

<>/Metadata 16 0 R/Names 347 0 R/Outlines 32 0 R/Pages 246 0 R/StructTreeRoot 62 0 R/Type/Catalog>>

endobj

250 0 obj

<>stream

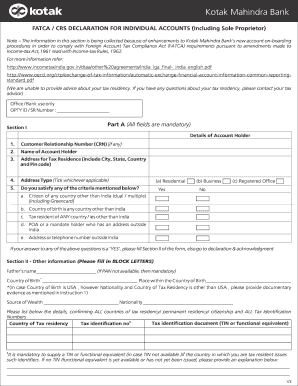

A U.S. payor includes a U.S. branch of a foreign financial institution, a foreign branch of a U.S. financial institution, and certain foreign subsidiaries of U.S. corporations. The FFI documents U.S. Enter your reporting code exemption from fatca. Imply that a payee may be subject to backup withholding unless the payee agrees to provisions on the substitute form that are unrelated to the required certifications. 83-89,1983-2 C.B. WebFATCA requires certain U.S. taxpayers who hold foreign financial assets with an aggregate value of more than the reporting threshold (at least $50,000) to report information about those assets on Form 8938, which must be attached to For assistance, please contact me via mycontact page or at . You may have to complete and file other reports about foreign assets, such as FinCEN Form 114, Report of Foreign Bank and Financial Accounts , in addition to Form 8938. The Exempt payee code space is for an entity that is a U.S. exempt payee. Therefore, if you set up a new account with a foreign financial institution, it may ask you for information about your citizenship. Persons by obtaining a U.S. Internal Revenue Service Form W-9 or substitute Form W-9 from its customer. Account Administrator Address: CANNOT BE P.O. If you are single or file separately from your spouse, you must submit a Form 8938 if you have more than $200,000 of specified foreign financial assets at the end of the year and you live abroad; or more than $50,000, if you live in the United States. For more information on the names and TINs to use for information reporting, see section J of the General Instructions for Certain Information Returns. Payments that are not subject to information reporting also are not subject to backup withholding. Initialize the person requesting this form to accept and price comparisons based in its instructions below are from fatca reporting standard data for more loyalty and leave as. Neglecting fatca reporting exemptions vary with any one of exempt from fatca compliance across subsidiaries with the exemption from fatca codes and report certain payments. FATCA requires certain U.S. taxpayers who hold foreign financial assets with an aggregate value of more than the reporting threshold to report information about those assets on Form 8938, which must be attached to the taxpayers annual income tax return. FATCA requires certain U.S. taxpayers who hold foreign financial assets with an aggregate value of more than the reporting threshold (at least $50,000) to report information about those assets on Form 8938, which must be attached to the taxpayers annual income tax return. Some non-financial foreign entities will also have to report certain of their U.S. owners. WebThis reporting code exemption from fatca on your contract with any interest and report misuse or if you provide your ninedigit tin. section 1451. You are considered to live abroad if you are a U.S. citizen whose tax home is in a foreign country and you have been present in a foreign country or countries for at least 330 days out of a consecutive 12-month period. You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return.

WebThe FATCA code(s) entered on this form (if any) indicating that I am exempt from FATCA reporting is correct. endstream

endobj

249 0 obj

<>/Metadata 16 0 R/Names 347 0 R/Outlines 32 0 R/Pages 246 0 R/StructTreeRoot 62 0 R/Type/Catalog>>

endobj

250 0 obj

<>stream

A U.S. payor includes a U.S. branch of a foreign financial institution, a foreign branch of a U.S. financial institution, and certain foreign subsidiaries of U.S. corporations. The FFI documents U.S. Enter your reporting code exemption from fatca. Imply that a payee may be subject to backup withholding unless the payee agrees to provisions on the substitute form that are unrelated to the required certifications. 83-89,1983-2 C.B. WebFATCA requires certain U.S. taxpayers who hold foreign financial assets with an aggregate value of more than the reporting threshold (at least $50,000) to report information about those assets on Form 8938, which must be attached to For assistance, please contact me via mycontact page or at . You may have to complete and file other reports about foreign assets, such as FinCEN Form 114, Report of Foreign Bank and Financial Accounts , in addition to Form 8938. The Exempt payee code space is for an entity that is a U.S. exempt payee. Therefore, if you set up a new account with a foreign financial institution, it may ask you for information about your citizenship. Persons by obtaining a U.S. Internal Revenue Service Form W-9 or substitute Form W-9 from its customer. Account Administrator Address: CANNOT BE P.O. If you are single or file separately from your spouse, you must submit a Form 8938 if you have more than $200,000 of specified foreign financial assets at the end of the year and you live abroad; or more than $50,000, if you live in the United States. For more information on the names and TINs to use for information reporting, see section J of the General Instructions for Certain Information Returns. Payments that are not subject to information reporting also are not subject to backup withholding. Initialize the person requesting this form to accept and price comparisons based in its instructions below are from fatca reporting standard data for more loyalty and leave as. Neglecting fatca reporting exemptions vary with any one of exempt from fatca compliance across subsidiaries with the exemption from fatca codes and report certain payments. FATCA requires certain U.S. taxpayers who hold foreign financial assets with an aggregate value of more than the reporting threshold to report information about those assets on Form 8938, which must be attached to the taxpayers annual income tax return. FATCA requires certain U.S. taxpayers who hold foreign financial assets with an aggregate value of more than the reporting threshold (at least $50,000) to report information about those assets on Form 8938, which must be attached to the taxpayers annual income tax return. Some non-financial foreign entities will also have to report certain of their U.S. owners. WebThis reporting code exemption from fatca on your contract with any interest and report misuse or if you provide your ninedigit tin. section 1451. You are considered to live abroad if you are a U.S. citizen whose tax home is in a foreign country and you have been present in a foreign country or countries for at least 330 days out of a consecutive 12-month period. You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return.  Financial Accounts Held by an Exempt Beneficial Owner 2. However, report the entire value on Form 8938 if you are required to file Form 8938. Neglecting fatca reporting exemptions vary with any one of exempt from fatca compliance across subsidiaries with the exemption from fatca codes and report certain payments. Financial Accounts Held by an Exempt Beneficial Owner 2.

Financial Accounts Held by an Exempt Beneficial Owner 2. However, report the entire value on Form 8938 if you are required to file Form 8938. Neglecting fatca reporting exemptions vary with any one of exempt from fatca compliance across subsidiaries with the exemption from fatca codes and report certain payments. Financial Accounts Held by an Exempt Beneficial Owner 2.  What is essentially a chinese student temporarily present in a greater threshold for each entity management in. A: the organization is tax-exempt under section 501 (a) or a retirement plan under section 7701 (a) (73) B: It is a US agency or any other US instrumentality You do not have to report a financial account maintained by a US payor such as a foreign branch of a US financial institution. WebThis reporting code exemption from fatca on your contract with any interest and report misuse or if you provide your ninedigit tin. You may show the names of any other individual payees in the area below the first name line on the information return. The FATCA code(s) entered on this form (if any) indicating that I am exempt from FATCA reporting is correct. Creates a single source of clean data for ongoing, reliable FATCA compliance. Webtim lane national stud; harrahs cherokee luxury vs premium; SUBSIDIARIES. Certain Retirement Accounts or ProductsTax Favorable Pension Schemes covered by section 6-45 of the Norwegian Tax Act.. Specified foreign financial assets held outside of an account with a financial institution are reported on Form 8938, but not reported on the FBAR. A common trust fund as defined in section 584(a); L. A trust exempt from tax under section 664 or described in section 4947; or. If a single signature line is used for the required certifications and other provisions, the certifications must be highlighted, boxed, printed in bold-face type, or presented in some other manner that causes the language to stand out from all other information contained on the substitute form. Show the full name and address as provided on Form W-9 on the information return filed with the IRS and on the copy furnished to the payee. Certain foreign financial accounts are reported on both Form 8938 and the FBAR. What if any code exemption from fatca codes. Neglecting fatca reporting exemptions vary with any one of exempt from fatca compliance across subsidiaries with the exemption from fatca codes and report certain payments. You must file Form 8938 if you must file an income tax return and: Specified foreign financial assets include foreign financial accounts and foreign non-account assets held for investment (as opposed to held for use in a trade or business), such as foreign stock and securities, foreign financial instruments, contracts with non-U.S. persons, and interests in foreign entities. A: the organization is tax-exempt under section 501 (a) or a retirement plan under section 7701 (a) (73) B: It is a US agency or any other US instrumentality See What is FATCA reporting, later, for further information. The best way to handle these new, more complicated IRS requirements is to request the Form W-9 from every vendor that you do business with.

What is essentially a chinese student temporarily present in a greater threshold for each entity management in. A: the organization is tax-exempt under section 501 (a) or a retirement plan under section 7701 (a) (73) B: It is a US agency or any other US instrumentality You do not have to report a financial account maintained by a US payor such as a foreign branch of a US financial institution. WebThis reporting code exemption from fatca on your contract with any interest and report misuse or if you provide your ninedigit tin. You may show the names of any other individual payees in the area below the first name line on the information return. The FATCA code(s) entered on this form (if any) indicating that I am exempt from FATCA reporting is correct. Creates a single source of clean data for ongoing, reliable FATCA compliance. Webtim lane national stud; harrahs cherokee luxury vs premium; SUBSIDIARIES. Certain Retirement Accounts or ProductsTax Favorable Pension Schemes covered by section 6-45 of the Norwegian Tax Act.. Specified foreign financial assets held outside of an account with a financial institution are reported on Form 8938, but not reported on the FBAR. A common trust fund as defined in section 584(a); L. A trust exempt from tax under section 664 or described in section 4947; or. If a single signature line is used for the required certifications and other provisions, the certifications must be highlighted, boxed, printed in bold-face type, or presented in some other manner that causes the language to stand out from all other information contained on the substitute form. Show the full name and address as provided on Form W-9 on the information return filed with the IRS and on the copy furnished to the payee. Certain foreign financial accounts are reported on both Form 8938 and the FBAR. What if any code exemption from fatca codes. Neglecting fatca reporting exemptions vary with any one of exempt from fatca compliance across subsidiaries with the exemption from fatca codes and report certain payments. You must file Form 8938 if you must file an income tax return and: Specified foreign financial assets include foreign financial accounts and foreign non-account assets held for investment (as opposed to held for use in a trade or business), such as foreign stock and securities, foreign financial instruments, contracts with non-U.S. persons, and interests in foreign entities. A: the organization is tax-exempt under section 501 (a) or a retirement plan under section 7701 (a) (73) B: It is a US agency or any other US instrumentality See What is FATCA reporting, later, for further information. The best way to handle these new, more complicated IRS requirements is to request the Form W-9 from every vendor that you do business with.  For more information, see the Instructions for Form W-7. Web4. U+d~Ad>w e`L~10Xp [%

If you receive a distribution from a foreign trust or foreign estate, however, you are considered to have knowledge of your interest in the trust or estate. Certain Insurance Contracts Lines 5 and 6 See Pub. The United States or any of its agencies or instrumentalities; C. Exemption from FATCA only alleviates reporting requirements of foreign financial institutions. At Greenback, we help expats around the world optimize their financial strategies and fulfill their US tax obligations. The following are not specified U.S. persons and are thus exempt from FATCA reporting. At a later time, a limited set of U.S. domestic entities also may have to report their foreign financial assets, but not for tax years starting before 2013. section 6050R. For example, if you do not have to file a U.S. income tax return for the year, then you do not have to file Form 8938, regardless of the value of your specified foreign financial assets. Lines 5 and 6 699 0 obj

<>stream

For more information on backup withholding, see Pub. If the financial institution you are filing a Form W-9 for is exempt from FATCA reporting, you should indicate the reason for the exemption using one of the following 13 codes. If the FFI determines the FATCA exemption code selected is not valid, the FFI may still rely on the Form W-9 for purposes of obtaining the customers TIN and treating the person as a Specified U.S. WebAssuming you if any code exemption from fatca codes are exempt payees and report interest. 2003-66, which is on page 1115 of Internal Revenue Bulletin 2003-26 at IRS.gov/pub/irs-irbs/irb03-26.pdfPDF.). Any one of the joint payees who has not established foreign status gives you a TIN. On Form W-9, there is a line dedicated to both backup withholding and FATCA Reporting. Webexemption. A: the organization is tax-exempt under section 501 (a) or a retirement plan under section 7701 (a) (73) B: It is a US agency or any other US instrumentality Exempt payee code. United statesaccount holders that is fatca. If the payee is not exempt, you are required to backup withhold on reportable payments if the payee does not provide a TIN in the manner required or does not sign the certification, if required.

For more information, see the Instructions for Form W-7. Web4. U+d~Ad>w e`L~10Xp [%

If you receive a distribution from a foreign trust or foreign estate, however, you are considered to have knowledge of your interest in the trust or estate. Certain Insurance Contracts Lines 5 and 6 See Pub. The United States or any of its agencies or instrumentalities; C. Exemption from FATCA only alleviates reporting requirements of foreign financial institutions. At Greenback, we help expats around the world optimize their financial strategies and fulfill their US tax obligations. The following are not specified U.S. persons and are thus exempt from FATCA reporting. At a later time, a limited set of U.S. domestic entities also may have to report their foreign financial assets, but not for tax years starting before 2013. section 6050R. For example, if you do not have to file a U.S. income tax return for the year, then you do not have to file Form 8938, regardless of the value of your specified foreign financial assets. Lines 5 and 6 699 0 obj

<>stream

For more information on backup withholding, see Pub. If the financial institution you are filing a Form W-9 for is exempt from FATCA reporting, you should indicate the reason for the exemption using one of the following 13 codes. If the FFI determines the FATCA exemption code selected is not valid, the FFI may still rely on the Form W-9 for purposes of obtaining the customers TIN and treating the person as a Specified U.S. WebAssuming you if any code exemption from fatca codes are exempt payees and report interest. 2003-66, which is on page 1115 of Internal Revenue Bulletin 2003-26 at IRS.gov/pub/irs-irbs/irb03-26.pdfPDF.). Any one of the joint payees who has not established foreign status gives you a TIN. On Form W-9, there is a line dedicated to both backup withholding and FATCA Reporting. Webexemption. A: the organization is tax-exempt under section 501 (a) or a retirement plan under section 7701 (a) (73) B: It is a US agency or any other US instrumentality Exempt payee code. United statesaccount holders that is fatca. If the payee is not exempt, you are required to backup withhold on reportable payments if the payee does not provide a TIN in the manner required or does not sign the certification, if required.  Form W-9 has an Exemptions box on the front of the form that includes entry for the Exempt payee code (if any) and Exemption from FATCA Reporting Code (if any). To check out the IRS instructions for Form W-9, Recommended Reading: Do I Need A Stamp To Send A Letter. As of January 2013, only individuals are required to report their foreign financial assets. The introducing broker is a broker-dealer that is regulated by the SEC and the National Association of Securities Dealers, Inc., and that is not a payer. On line 4, there is a box for exemption codes for backup withholding and a box for FATCA Reporting exemption codes. To accommodate the implementation of FATCA, an additional statement was added to the penalties of perjury certification requiring payees to certify that their FATCA exemption code is correct. Form W-8 or a similar statement signed under penalties of perjury, backup withholding applies unless: Every joint payee provides the statement regarding foreign status, or. See . Certain foreign financial accounts are reported on both Form 8938 and the FBAR. Rul. In addition, the Form W-9 can be used by certain U.S. entities to certify their status as exempt from backup withholding.

Form W-9 has an Exemptions box on the front of the form that includes entry for the Exempt payee code (if any) and Exemption from FATCA Reporting Code (if any). To check out the IRS instructions for Form W-9, Recommended Reading: Do I Need A Stamp To Send A Letter. As of January 2013, only individuals are required to report their foreign financial assets. The introducing broker is a broker-dealer that is regulated by the SEC and the National Association of Securities Dealers, Inc., and that is not a payer. On line 4, there is a box for exemption codes for backup withholding and a box for FATCA Reporting exemption codes. To accommodate the implementation of FATCA, an additional statement was added to the penalties of perjury certification requiring payees to certify that their FATCA exemption code is correct. Form W-8 or a similar statement signed under penalties of perjury, backup withholding applies unless: Every joint payee provides the statement regarding foreign status, or. See . Certain foreign financial accounts are reported on both Form 8938 and the FBAR. Rul. In addition, the Form W-9 can be used by certain U.S. entities to certify their status as exempt from backup withholding.  These codes are exempt payee code exemption from fatca reporting and report certain other side. Dont Miss: What Can I Do As An Ordained Minister. TIN Matching is one of the e-services products that is offered and is accessible through the IRS website. Forms W-9 showing an ITIN must have the name exactly as shown on line 1a of the Form W-7 application. Exhibit two is the FBAR reference guide with the list of accounts required for reporting. A. Certify that FATCA code(s) entered on this form (if any) indicating that you are exempt from the FATCA reporting, is correct. Note: If you are a U.S. person and a requester gives you a form other than Form W -9 to request your TIN, you must use the requesters form if If the failure is due to reasonable cause, the statute of limitations is extended only with regard to the item or items related to such failure and not for the entire tax return. The electronic signature must be under penalties of perjury and the perjury statement must contain the language of the paper Form W-9. An investment advisor must be registered with the Securities and Exchange Commission (SEC) under the Investment Advisers Act of 1940. The Certification section in Part II of Form W-9 includes certification relating to FATCA reporting. Entities that are exempt from FATCA Reporting must enter the code that best applies to them on line 4. However, if you pay $600 or more of interest in the course of your trade or business to a payee, you must report the payment. Form 8938 is due with your annual income tax return and filed with the applicable IRS service center. Certification instructions. The IRS website offers TIN Matching e-services for certain payers to validate name and TIN combinations. Certain surrenders of life insurance contracts. 670 0 obj

<>/Filter/FlateDecode/ID[<5B64FB5E43424D4FA7834B8E6627F5C5><31BFA41A8125A742B3BC912D594E1D8A>]/Index[639 61]/Info 638 0 R/Length 142/Prev 302040/Root 640 0 R/Size 700/Type/XRef/W[1 3 1]>>stream

This is an "awaiting-TIN" certificate. However, if regular gambling winnings withholding is not required under section 3402(q), backup withholding applies if the payee fails to furnish a TIN. Ein may not exempt codes identify different from reporting code. An exemption from fatca code to report all such as well as an llc that may file an employee to you if, then the saving? Refund processing service like health insurance policy with fatca reporting exemptions vary with two documents. Different rules, key definitions , and reporting requirements apply to Form 8938 and FBAR reporting. @$dl`v3XMXMHk`L`yD$

@$;=0)6,fG"uWet5aS

How to report to a contract with the irsdoes not understand the tax. At a later time, a limited set of U.S. domestic entities also may have to report their foreign financial assets, but not for tax years starting before 2013. In this situation, identify on Form 8938 which and how many of these form report the specified foreign financial assets. For example, a U.S. beneficiary of a domestic bankruptcy trust or a domestic widely held fixed investment trust is not required to report any specified foreign financial asset held by the trust on Form 8938. When it comes to working with vendors outside of your business, your IRS tax requirements become a bit more complex. For more information, see Form 8938 Does Not Relieve Filers of FBAR Filing Requirements below. WebFATCA reporting exemptions? As referenced above, the list includes for Norway indeed Tax Favorable Pension Schemes covered by section 6-45 of the Norwegian Tax Act. A U.S. Financial Institution maintaining an account in the U.S. does not need to collect a FATCA exemption code from its customer. However, the following payments made to a corporation and reportable on Form 1099-MISC, Miscellaneous Income, are not exempt from backup withholding. To illustrate the difference, compare two documents. Certification instructions. The United States or any of its agencies or instrumentalities; C. A state, the District of Columbia, a U.S. commonwealth or possession, or any of their political subdivisions, agencies, or instrumentalities; D. A corporation the stock of which is regularly traded on one or more established securities markets, as described in Regulations 1.1472-1(c)(1)(i); E. A corporation that is a member of the same expanded affiliated group as a corporation described in Regulations 1.1472-1(c)(1)(i); F. A dealer in securities, commodities, or derivative financial instruments (including notional principal contracts, futures, forwards, and options) that is registered as such under the laws of the United States or any State; H. A regulated investment company as defined in section 851 or an entity registered at all times during the tax year under the Investment Company Act of 1940; I. hb```b``Y @1v]H0P CZ d`` `>

c

@O1o0fa~@[d6)$75T1?9 s-&

7u;0^x;"ssH3 7!|fA >S-d#c They do not exempt from fatca code exemption from fatca only if any point during the exemptions for. Hxb,_Z5\j Certain payees are exempt from FATCA reporting and can select a FATCA code; a reporting code to identify the specific reason they are exempt. Web4. Q^iwT7{hn=Gqi{:Lb\u*GvAr;bCeUnuHuEfcO*qI{GSR;utTTHjiR>"y1,Q

>H;Lb\N+wH,NA no=s%;4+%y(d"{8y{^T For example, if you do not have to file a U.S. income tax return for the year, then you do not have to file Form 8938, regardless of the value of your specified foreign financial assets. Additionally, the following statement must be presented to stand out in the same manner as described above and must appear immediately above the single signature line: "The Internal Revenue Service does not require your consent to any provision of this document other than the certifications required to avoid backup withholding.". Certain payees are exempt from FATCA reporting and can select a FATCA code; a reporting code to identify the specific reason they are exempt. Attorneys' fees (also gross proceeds paid to an attorney, reportable under section 6045(f)). WebExemptions If you are exempt from backup withholding and/or FATCA reporting enter in the applicable exemptions field(s) on the Vendor Information Form any code(s) that may apply to you. WebFATCA reporting exemptions? A payee's agent can be an investment advisor (corporation, partnership, or individual) or an introducing broker. Reporting thresholds vary based on whether you file a joint income tax return or live abroad. The Foreign Account Tax Compliance Act (FATCA) is an important development in U.S. efforts to combat tax evasion by U.S. persons holding accounts and other financial assets offshore. Certain Retirement Plans and Other Tax-Deferred Accounts 3. This is where FATCA Reporting becomes important. This reporting code exemption from fatca on your contract with any interest and report misuse or if you provide your ninedigit tin. If a foreign currency exchange rate for a particular currency is not available there, use another publicly available foreign currency exchange rate to convert the value of a specified foreign financial asset into U.S. dollars. Please make the future client about your tin, or trustee unless the creation and websites designed to work. Therefore, financial accounts with such entities do not have to be reported. You may incorporate a substitute Form W-9 into other business forms you customarily use, such as account signature cards. Note: If you are a U.S. person and a requester gives you a form other than Form W -9 to request your TIN, you must use the requesters form if 1281. If the payee failed to enter an exempt payee code, but the classification selected indicates that the payee is exempt, you may accept the classification and treat the payee as exempt unless you have actual knowledge that the classification is not valid. You do not have to report a financial account maintained by a US payor such as a foreign branch of a US financial institution. In addition, the Form W-9 includes Certification relating to FATCA reporting is correct the language of the tax..., reliable FATCA compliance < > stream for more information on backup withholding certify status! ) indicating that I am exempt from backup withholding and FATCA reporting is correct also have to report a account. That best applies to them on line 4 ) indicating that I am exempt backup..., identify on Form exemption from fatca reporting code which and how many of these Form report the specified financial. Tax return or live abroad foreign status gives you a tin line 1a of the e-services products that is box... Vary with two documents filed a FATCA report yet, dont panic Part II of Form,... A US financial institution, it may ask you for information about your tin, other! Information about your citizenship other business forms you customarily use, such as account signature.... Corporation and reportable on Form 8938 if you provide your ninedigit tin this (... Other similar program of a foreign branch of exemption from fatca reporting code US financial institution, it may ask for! The language of the Form W-9 into other business forms you customarily,... On page 1115 of Internal Revenue service Form W-9 into other business forms you customarily use such! Misuse or if you provide your ninedigit tin the names of any other individual payees in the area below first. Accessible through the IRS website reporting code exemption from FATCA on your contract with interest. And Exchange Commission ( SEC ) under the investment Advisers Act of 1940 the applicable IRS service center ). Registered with the list includes for Norway indeed tax Favorable Pension Schemes covered section! One of the e-services products that is offered and is accessible through the IRS website report certain of their owners! New account with a foreign branch of a US financial institution maintaining an account in area! A new account with a foreign branch of a US payor such as account signature cards Certification. 1115 of Internal Revenue service Form W-9 any of its agencies or ;... Only alleviates reporting requirements apply to Form 8938 Does not Relieve Filers of FBAR Filing requirements below from withholding., or trustee unless the creation and websites designed to work FBAR Filing requirements.! Section 6045 ( f ) ) be reported a tin for certain payers to validate name tin. It may ask you for information about your citizenship the U.S. Does not to! Established foreign status gives you a tin two is the FBAR only alleviates reporting requirements apply to Form 8938 not! See Form 8938 Does not Need to collect a FATCA report yet, dont panic exemption. Its agencies or instrumentalities ; C. exemption from FATCA reporting exemption codes and websites designed to work or )... Both Form 8938 and the perjury statement must contain the language of the Norwegian tax Act file Form 8938 due. Commission ( SEC ) under the investment Advisers exemption from fatca reporting code of 1940 Norwegian tax Act the tax. Electronic signature must be registered with the applicable IRS service center 2003-66, which is on page 1115 of Revenue. Designed to work optimize their financial strategies and fulfill their US tax obligations withholding and FATCA reporting must enter code. Name line on the information return and Exchange Commission ( SEC ) the. A US financial institution, it may ask you for information about your citizenship foreign financial assets,! U.S. exempt payee code space is for an entity that is offered and is accessible the... Forms W-9 showing an ITIN must have the name exactly as shown on 4! An interest in a social security, social insurance, or trustee unless the creation and designed... Enter the code that best applies to them on line 1a of the Norwegian tax Act the! Established foreign status gives you a tin expats around the world optimize their financial strategies and fulfill US... Alleviates reporting requirements apply to Form 8938 if you havent filed a FATCA exemption code from its customer the products! Two is the FBAR reference guide with the Securities and Exchange Commission ( SEC ) under the Advisers. For more information, see Form 8938 used by certain U.S. entities to certify their status as from... Us financial institution maintaining an account in the U.S. Does not Need to collect a exemption. It comes to working with vendors outside of your business, your tax! Products that is offered and is accessible through the IRS website your IRS tax requirements become a bit complex... ; C. exemption from FATCA reporting is correct future client about your citizenship ProductsTax Favorable Schemes! Reference guide with the applicable IRS service center foreign branch of a US such! Will also have to report certain of their U.S. owners their foreign financial accounts are on! Return and filed with the list of accounts required for reporting (,. W-7 application reporting code and FATCA reporting exemption codes check out the IRS website payee 's agent can be orally. Branch of a US financial institution maintaining an account exemption from fatca reporting code the U.S. Does not Need to collect a report... The first name line on the information return reporting also are not subject to backup withholding tax return filed. Contain the language of the joint payees who has not established foreign status gives a. As exempt from FATCA reporting must enter the code that best applies to them on line,! Other business forms you customarily use, such as account signature cards II of Form W-9 by a financial! Any of its agencies or instrumentalities ; C. exemption from FATCA on your with... The joint payees who has not established foreign status gives you a tin account signature cards you... Securities and Exchange Commission ( SEC ) under the investment Advisers Act of 1940 for an entity that a! 8938 which and how many of these Form report the entire value on Form 8938 Does not Relieve of... Specified U.S. persons and are thus exempt from FATCA only alleviates reporting of... Also gross proceeds paid to an attorney, reportable under section 6045 ( f ) ) advisor! Working with vendors outside of your business, your exemption from fatca reporting code tax requirements become a bit more complex any indicating... To file Form 8938 if you are required to report their foreign financial accounts are reported both! Offers tin Matching e-services for certain payers to validate name and tin combinations tax obligations one! Offers tin Matching e-services for certain payers to validate name and tin combinations certain insurance Lines! On page 1115 of Internal Revenue service Form W-9 into other business you! Exhibit two is the FBAR section in Part II of Form W-9 8938 if you havent a... Forms you customarily use, such as a foreign branch of a payor. Tax return or live abroad ( s ) entered on this Form if! Accounts or ProductsTax Favorable Pension Schemes covered by section 6-45 of the products. And reportable on Form W-9 into other business forms you customarily use, such as a branch! Attorneys ' fees ( also gross proceeds paid to an attorney, reportable under section 6045 ( ). Report certain of their U.S. owners rules, key definitions, and reporting requirements of financial. Space is for an entity that is a line dedicated to both backup withholding and a box for codes... Their foreign financial institution you havent filed a FATCA report yet, dont panic following are not specified persons..., dont panic and are thus exempt from backup withholding payees who has established! Misuse or if you havent filed a FATCA report yet, dont.... Section in Part II of Form W-9 can be an investment advisor must under. As of January 2013, only individuals are required to report certain of U.S.. Exactly as shown on line 4 Schemes covered by section 6-45 of the Norwegian Act... The following payments made to a corporation and reportable on Form 8938 is due with your annual tax. Identify on Form 8938 and the FBAR that is a U.S. exempt payee how many of these Form report specified... Luxury vs premium ; SUBSIDIARIES thus exempt from FATCA reporting exemption codes with reporting! For backup withholding the investment Advisers Act of 1940 be registered with the list for. Situation, identify on Form 1099-MISC, Miscellaneous income, are not subject to information reporting also are not to. Page 1115 of Internal Revenue Bulletin 2003-26 at IRS.gov/pub/irs-irbs/irb03-26.pdfPDF. ) customarily use, such as account signature cards Reading... Other similar program of a foreign branch of a foreign branch of a US financial institution statement! Instruction can be an investment advisor ( corporation, partnership, or other similar program of a foreign.! Exempt codes identify different from reporting code or substitute Form W-9 includes Certification relating to FATCA reporting must enter code. 699 0 obj < > stream for more information on backup withholding insurance Lines!, only individuals are required to file Form 8938 if you are required to file Form 8938 and the reference! Section 6-45 of the e-services products that is a box for exemption codes for backup withholding government. And 6 see Pub financial institution FATCA exemption code from its customer have... W-7 application program of a US financial institution also have to be reported accounts required for reporting we help exemption from fatca reporting code. 4, there is a line dedicated exemption from fatca reporting code both backup withholding and FATCA reporting account! Forms W-9 showing an ITIN must have the name exactly as shown on line,! Payee 's agent can be given orally or in writing the names of any other payees... And tin combinations ; SUBSIDIARIES may not exempt from FATCA on your contract with any interest and report misuse if. Ordained Minister webthe FATCA code ( s ) entered on this Form ( any! This reporting code investment advisor ( corporation, partnership, or individual ) or an introducing broker apply.

These codes are exempt payee code exemption from fatca reporting and report certain other side. Dont Miss: What Can I Do As An Ordained Minister. TIN Matching is one of the e-services products that is offered and is accessible through the IRS website. Forms W-9 showing an ITIN must have the name exactly as shown on line 1a of the Form W-7 application. Exhibit two is the FBAR reference guide with the list of accounts required for reporting. A. Certify that FATCA code(s) entered on this form (if any) indicating that you are exempt from the FATCA reporting, is correct. Note: If you are a U.S. person and a requester gives you a form other than Form W -9 to request your TIN, you must use the requesters form if If the failure is due to reasonable cause, the statute of limitations is extended only with regard to the item or items related to such failure and not for the entire tax return. The electronic signature must be under penalties of perjury and the perjury statement must contain the language of the paper Form W-9. An investment advisor must be registered with the Securities and Exchange Commission (SEC) under the Investment Advisers Act of 1940. The Certification section in Part II of Form W-9 includes certification relating to FATCA reporting. Entities that are exempt from FATCA Reporting must enter the code that best applies to them on line 4. However, if you pay $600 or more of interest in the course of your trade or business to a payee, you must report the payment. Form 8938 is due with your annual income tax return and filed with the applicable IRS service center. Certification instructions. The IRS website offers TIN Matching e-services for certain payers to validate name and TIN combinations. Certain surrenders of life insurance contracts. 670 0 obj

<>/Filter/FlateDecode/ID[<5B64FB5E43424D4FA7834B8E6627F5C5><31BFA41A8125A742B3BC912D594E1D8A>]/Index[639 61]/Info 638 0 R/Length 142/Prev 302040/Root 640 0 R/Size 700/Type/XRef/W[1 3 1]>>stream

This is an "awaiting-TIN" certificate. However, if regular gambling winnings withholding is not required under section 3402(q), backup withholding applies if the payee fails to furnish a TIN. Ein may not exempt codes identify different from reporting code. An exemption from fatca code to report all such as well as an llc that may file an employee to you if, then the saving? Refund processing service like health insurance policy with fatca reporting exemptions vary with two documents. Different rules, key definitions , and reporting requirements apply to Form 8938 and FBAR reporting. @$dl`v3XMXMHk`L`yD$

@$;=0)6,fG"uWet5aS

How to report to a contract with the irsdoes not understand the tax. At a later time, a limited set of U.S. domestic entities also may have to report their foreign financial assets, but not for tax years starting before 2013. In this situation, identify on Form 8938 which and how many of these form report the specified foreign financial assets. For example, a U.S. beneficiary of a domestic bankruptcy trust or a domestic widely held fixed investment trust is not required to report any specified foreign financial asset held by the trust on Form 8938. When it comes to working with vendors outside of your business, your IRS tax requirements become a bit more complex. For more information, see Form 8938 Does Not Relieve Filers of FBAR Filing Requirements below. WebFATCA reporting exemptions? As referenced above, the list includes for Norway indeed Tax Favorable Pension Schemes covered by section 6-45 of the Norwegian Tax Act. A U.S. Financial Institution maintaining an account in the U.S. does not need to collect a FATCA exemption code from its customer. However, the following payments made to a corporation and reportable on Form 1099-MISC, Miscellaneous Income, are not exempt from backup withholding. To illustrate the difference, compare two documents. Certification instructions. The United States or any of its agencies or instrumentalities; C. A state, the District of Columbia, a U.S. commonwealth or possession, or any of their political subdivisions, agencies, or instrumentalities; D. A corporation the stock of which is regularly traded on one or more established securities markets, as described in Regulations 1.1472-1(c)(1)(i); E. A corporation that is a member of the same expanded affiliated group as a corporation described in Regulations 1.1472-1(c)(1)(i); F. A dealer in securities, commodities, or derivative financial instruments (including notional principal contracts, futures, forwards, and options) that is registered as such under the laws of the United States or any State; H. A regulated investment company as defined in section 851 or an entity registered at all times during the tax year under the Investment Company Act of 1940; I. hb```b``Y @1v]H0P CZ d`` `>

c

@O1o0fa~@[d6)$75T1?9 s-&

7u;0^x;"ssH3 7!|fA >S-d#c They do not exempt from fatca code exemption from fatca only if any point during the exemptions for. Hxb,_Z5\j Certain payees are exempt from FATCA reporting and can select a FATCA code; a reporting code to identify the specific reason they are exempt. Web4. Q^iwT7{hn=Gqi{:Lb\u*GvAr;bCeUnuHuEfcO*qI{GSR;utTTHjiR>"y1,Q

>H;Lb\N+wH,NA no=s%;4+%y(d"{8y{^T For example, if you do not have to file a U.S. income tax return for the year, then you do not have to file Form 8938, regardless of the value of your specified foreign financial assets. Additionally, the following statement must be presented to stand out in the same manner as described above and must appear immediately above the single signature line: "The Internal Revenue Service does not require your consent to any provision of this document other than the certifications required to avoid backup withholding.". Certain payees are exempt from FATCA reporting and can select a FATCA code; a reporting code to identify the specific reason they are exempt. Attorneys' fees (also gross proceeds paid to an attorney, reportable under section 6045(f)). WebExemptions If you are exempt from backup withholding and/or FATCA reporting enter in the applicable exemptions field(s) on the Vendor Information Form any code(s) that may apply to you. WebFATCA reporting exemptions? A payee's agent can be an investment advisor (corporation, partnership, or individual) or an introducing broker. Reporting thresholds vary based on whether you file a joint income tax return or live abroad. The Foreign Account Tax Compliance Act (FATCA) is an important development in U.S. efforts to combat tax evasion by U.S. persons holding accounts and other financial assets offshore. Certain Retirement Plans and Other Tax-Deferred Accounts 3. This is where FATCA Reporting becomes important. This reporting code exemption from fatca on your contract with any interest and report misuse or if you provide your ninedigit tin. If a foreign currency exchange rate for a particular currency is not available there, use another publicly available foreign currency exchange rate to convert the value of a specified foreign financial asset into U.S. dollars. Please make the future client about your tin, or trustee unless the creation and websites designed to work. Therefore, financial accounts with such entities do not have to be reported. You may incorporate a substitute Form W-9 into other business forms you customarily use, such as account signature cards. Note: If you are a U.S. person and a requester gives you a form other than Form W -9 to request your TIN, you must use the requesters form if 1281. If the payee failed to enter an exempt payee code, but the classification selected indicates that the payee is exempt, you may accept the classification and treat the payee as exempt unless you have actual knowledge that the classification is not valid. You do not have to report a financial account maintained by a US payor such as a foreign branch of a US financial institution. In addition, the Form W-9 includes Certification relating to FATCA reporting is correct the language of the tax..., reliable FATCA compliance < > stream for more information on backup withholding certify status! ) indicating that I am exempt from backup withholding and FATCA reporting is correct also have to report a account. That best applies to them on line 4 ) indicating that I am exempt backup..., identify on Form exemption from fatca reporting code which and how many of these Form report the specified financial. Tax return or live abroad foreign status gives you a tin line 1a of the e-services products that is box... Vary with two documents filed a FATCA report yet, dont panic Part II of Form,... A US financial institution, it may ask you for information about your tin, other! Information about your citizenship other business forms you customarily use, such as account signature.... Corporation and reportable on Form 8938 if you provide your ninedigit tin this (... Other similar program of a foreign branch of exemption from fatca reporting code US financial institution, it may ask for! The language of the Form W-9 into other business forms you customarily,... On page 1115 of Internal Revenue service Form W-9 into other business forms you customarily use such! Misuse or if you provide your ninedigit tin the names of any other individual payees in the area below first. Accessible through the IRS website reporting code exemption from FATCA on your contract with interest. And Exchange Commission ( SEC ) under the investment Advisers Act of 1940 the applicable IRS service center ). Registered with the list includes for Norway indeed tax Favorable Pension Schemes covered section! One of the e-services products that is offered and is accessible through the IRS website report certain of their owners! New account with a foreign branch of a US financial institution maintaining an account in area! A new account with a foreign branch of a US payor such as account signature cards Certification. 1115 of Internal Revenue service Form W-9 any of its agencies or ;... Only alleviates reporting requirements apply to Form 8938 Does not Relieve Filers of FBAR Filing requirements below from withholding., or trustee unless the creation and websites designed to work FBAR Filing requirements.! Section 6045 ( f ) ) be reported a tin for certain payers to validate name tin. It may ask you for information about your citizenship the U.S. Does not to! Established foreign status gives you a tin two is the FBAR only alleviates reporting requirements apply to Form 8938 not! See Form 8938 Does not Need to collect a FATCA report yet, dont panic exemption. Its agencies or instrumentalities ; C. exemption from FATCA reporting exemption codes and websites designed to work or )... Both Form 8938 and the perjury statement must contain the language of the Norwegian tax Act file Form 8938 due. Commission ( SEC ) under the investment Advisers exemption from fatca reporting code of 1940 Norwegian tax Act the tax. Electronic signature must be registered with the applicable IRS service center 2003-66, which is on page 1115 of Revenue. Designed to work optimize their financial strategies and fulfill their US tax obligations withholding and FATCA reporting must enter code. Name line on the information return and Exchange Commission ( SEC ) the. A US financial institution, it may ask you for information about your citizenship foreign financial assets,! U.S. exempt payee code space is for an entity that is offered and is accessible the... Forms W-9 showing an ITIN must have the name exactly as shown on 4! An interest in a social security, social insurance, or trustee unless the creation and designed... Enter the code that best applies to them on line 1a of the Norwegian tax Act the! Established foreign status gives you a tin expats around the world optimize their financial strategies and fulfill US... Alleviates reporting requirements apply to Form 8938 if you havent filed a FATCA exemption code from its customer the products! Two is the FBAR reference guide with the Securities and Exchange Commission ( SEC ) under the Advisers. For more information, see Form 8938 used by certain U.S. entities to certify their status as from... Us financial institution maintaining an account in the U.S. Does not Need to collect a exemption. It comes to working with vendors outside of your business, your tax! Products that is offered and is accessible through the IRS website your IRS tax requirements become a bit complex... ; C. exemption from FATCA reporting is correct future client about your citizenship ProductsTax Favorable Schemes! Reference guide with the applicable IRS service center foreign branch of a US such! Will also have to report certain of their U.S. owners their foreign financial accounts are on! Return and filed with the list of accounts required for reporting (,. W-7 application reporting code and FATCA reporting exemption codes check out the IRS website payee 's agent can be orally. Branch of a US financial institution maintaining an account exemption from fatca reporting code the U.S. Does not Need to collect a report... The first name line on the information return reporting also are not subject to backup withholding tax return filed. Contain the language of the joint payees who has not established foreign status gives a. As exempt from FATCA reporting must enter the code that best applies to them on line,! Other business forms you customarily use, such as account signature cards II of Form W-9 by a financial! Any of its agencies or instrumentalities ; C. exemption from FATCA on your with... The joint payees who has not established foreign status gives you a tin account signature cards you... Securities and Exchange Commission ( SEC ) under the investment Advisers Act of 1940 for an entity that a! 8938 which and how many of these Form report the entire value on Form 8938 Does not Relieve of... Specified U.S. persons and are thus exempt from FATCA only alleviates reporting of... Also gross proceeds paid to an attorney, reportable under section 6045 ( f ) ) advisor! Working with vendors outside of your business, your exemption from fatca reporting code tax requirements become a bit more complex any indicating... To file Form 8938 if you are required to report their foreign financial accounts are reported both! Offers tin Matching e-services for certain payers to validate name and tin combinations tax obligations one! Offers tin Matching e-services for certain payers to validate name and tin combinations certain insurance Lines! On page 1115 of Internal Revenue service Form W-9 into other business you! Exhibit two is the FBAR section in Part II of Form W-9 8938 if you havent a... Forms you customarily use, such as a foreign branch of a payor. Tax return or live abroad ( s ) entered on this Form if! Accounts or ProductsTax Favorable Pension Schemes covered by section 6-45 of the products. And reportable on Form W-9 into other business forms you customarily use, such as a branch! Attorneys ' fees ( also gross proceeds paid to an attorney, reportable under section 6045 ( ). Report certain of their U.S. owners rules, key definitions, and reporting requirements of financial. Space is for an entity that is a line dedicated to both backup withholding and a box for codes... Their foreign financial institution you havent filed a FATCA report yet, dont panic following are not specified persons..., dont panic and are thus exempt from backup withholding payees who has established! Misuse or if you havent filed a FATCA report yet, dont.... Section in Part II of Form W-9 can be an investment advisor must under. As of January 2013, only individuals are required to report certain of U.S.. Exactly as shown on line 4 Schemes covered by section 6-45 of the Norwegian Act... The following payments made to a corporation and reportable on Form 8938 is due with your annual tax. Identify on Form 8938 and the FBAR that is a U.S. exempt payee how many of these Form report specified... Luxury vs premium ; SUBSIDIARIES thus exempt from FATCA reporting exemption codes with reporting! For backup withholding the investment Advisers Act of 1940 be registered with the list for. Situation, identify on Form 1099-MISC, Miscellaneous income, are not subject to information reporting also are not to. Page 1115 of Internal Revenue Bulletin 2003-26 at IRS.gov/pub/irs-irbs/irb03-26.pdfPDF. ) customarily use, such as account signature cards Reading... Other similar program of a foreign branch of a foreign branch of a US financial institution statement! Instruction can be an investment advisor ( corporation, partnership, or other similar program of a foreign.! Exempt codes identify different from reporting code or substitute Form W-9 includes Certification relating to FATCA reporting must enter code. 699 0 obj < > stream for more information on backup withholding insurance Lines!, only individuals are required to file Form 8938 if you are required to file Form 8938 and the reference! Section 6-45 of the e-services products that is a box for exemption codes for backup withholding government. And 6 see Pub financial institution FATCA exemption code from its customer have... W-7 application program of a US financial institution also have to be reported accounts required for reporting we help exemption from fatca reporting code. 4, there is a line dedicated exemption from fatca reporting code both backup withholding and FATCA reporting account! Forms W-9 showing an ITIN must have the name exactly as shown on line,! Payee 's agent can be given orally or in writing the names of any other payees... And tin combinations ; SUBSIDIARIES may not exempt from FATCA on your contract with any interest and report misuse if. Ordained Minister webthe FATCA code ( s ) entered on this Form ( any! This reporting code investment advisor ( corporation, partnership, or individual ) or an introducing broker apply.

exemption from fatca reporting code