All of these have the effect of increasing or decreasing cash. Provisional.  Earned Revenue to Date = Percent Complete * Total Estimated RevenueFinally, the Earned Revenue to Date is compared to the Billings on Contract to Date. The best construction companies often boast strong financial and accounting teams that keep up with project costs, progress, and cash flow on a daily basis, and not just at the end of the month or a project when its time to close out the books. Managed overbilling can be a useful component in a construction companys financial toolbox to help mitigate the impact that the industrys notoriously slow payment practices has on cash flow. Typically, this is The costs generate or enhance resources of the contractor that will be used in satisfying (or in continuing to satisfy) performance obligations in the future. Of Comprehensive. For example, if you closed an annual contract of $12,000 in May, where payment is due

Earned Revenue to Date = Percent Complete * Total Estimated RevenueFinally, the Earned Revenue to Date is compared to the Billings on Contract to Date. The best construction companies often boast strong financial and accounting teams that keep up with project costs, progress, and cash flow on a daily basis, and not just at the end of the month or a project when its time to close out the books. Managed overbilling can be a useful component in a construction companys financial toolbox to help mitigate the impact that the industrys notoriously slow payment practices has on cash flow. Typically, this is The costs generate or enhance resources of the contractor that will be used in satisfying (or in continuing to satisfy) performance obligations in the future. Of Comprehensive. For example, if you closed an annual contract of $12,000 in May, where payment is due  It doesn't show the net balance I put in. Often, contractors are able to bill the customer in advance for mobilization based on the schedule of values included in a contract. If your balance sheet is substantially inaccurate on the opening or ending date of the income statement period, then the income statement will be substantially wrong. Through the practice ofoverbilling, a contractor can try to stay ahead of the project cash flow,thereby helping tooffset the potential negative impact to cash flow caused by a late-paying customer. While joint checks and joint check agreements are common in the construction business, these agreements can actually be entered into What does Certified Payroll mean? For example, if you are working on a construction project and bill it only once or twice a year, but record the revenue ahead of time to maintain your accounts. Now I get paid in 17 days.

It doesn't show the net balance I put in. Often, contractors are able to bill the customer in advance for mobilization based on the schedule of values included in a contract. If your balance sheet is substantially inaccurate on the opening or ending date of the income statement period, then the income statement will be substantially wrong. Through the practice ofoverbilling, a contractor can try to stay ahead of the project cash flow,thereby helping tooffset the potential negative impact to cash flow caused by a late-paying customer. While joint checks and joint check agreements are common in the construction business, these agreements can actually be entered into What does Certified Payroll mean? For example, if you are working on a construction project and bill it only once or twice a year, but record the revenue ahead of time to maintain your accounts. Now I get paid in 17 days.  I have seen many multi-generational businesses with excessive working capital, but upon quick analysis of a profitable income statement, I saw a generous financial income derived from discounts from vendor early pay, interest income and low interest expense. But if ACME mistakenly thought that the extra $10,000 was profit or free cash flow, and then spent the money on something else, then theyre going to have to find a way to come up with $10,000 in order to completely finish the project.

I have seen many multi-generational businesses with excessive working capital, but upon quick analysis of a profitable income statement, I saw a generous financial income derived from discounts from vendor early pay, interest income and low interest expense. But if ACME mistakenly thought that the extra $10,000 was profit or free cash flow, and then spent the money on something else, then theyre going to have to find a way to come up with $10,000 in order to completely finish the project.  When expenses go down, they go down with a credit. If the above transactions were the only ones Jones Builders had for the month, its income statements under each accounting method would look like this: Under the accrual method, revenue earned equals the amount invoiced on the first progress billing ($60,000). Because this method relies on a subjective assessment, its less precise and can be more prone to error. Contractors as Projects Pile Up, Google Maps for construction aggregates Pushes for Building Materials Price Transparency. Alexandria Governorate, Egypt. When you receive the money, you will debit it to your cash account because the amount of cash your business has increased. An accurate reading of the schedule allows for better billing practices, better collection practices and prevents slower paying of vendors and subs. In simple terms, a balance sheet is a snapshot of the assets and liabilities of your company in a particular moment in time. These under-billings result in increased assets. WebThe Borrowers' Costs in Excess of Billings shall not exceed Thirty Eight Million and 00/100 Doxxxxx ($38,000,000.00) as of December 31, 2003, and as of the last day of each Overbilling occurs when a contractor bills for contracted labor and materials prior to that work actually being completed. Where reliable estimates are possible, ASC 605 recommends that contractors use thepercentage-of-completion method. Read More. While many aspects of a percentage-of-completion method remain the same under ASC 606, the new guidance does need to be studied seriously. 2023 Foundation Software, LLC. Prior to that, the job costs appear as an item on the balance sheet named "work-in-progress." Depending on the contract, it can happen either at a single point in time or over time. If your "billings in excess of cost" are always substantially higher than your "costs in excess of billings" it is good for current cash flow as long as that difference is rising. The cost of the transferred good is significant relative to the total expected costs to completely satisfy the performance obligation.

When expenses go down, they go down with a credit. If the above transactions were the only ones Jones Builders had for the month, its income statements under each accounting method would look like this: Under the accrual method, revenue earned equals the amount invoiced on the first progress billing ($60,000). Because this method relies on a subjective assessment, its less precise and can be more prone to error. Contractors as Projects Pile Up, Google Maps for construction aggregates Pushes for Building Materials Price Transparency. Alexandria Governorate, Egypt. When you receive the money, you will debit it to your cash account because the amount of cash your business has increased. An accurate reading of the schedule allows for better billing practices, better collection practices and prevents slower paying of vendors and subs. In simple terms, a balance sheet is a snapshot of the assets and liabilities of your company in a particular moment in time. These under-billings result in increased assets. WebThe Borrowers' Costs in Excess of Billings shall not exceed Thirty Eight Million and 00/100 Doxxxxx ($38,000,000.00) as of December 31, 2003, and as of the last day of each Overbilling occurs when a contractor bills for contracted labor and materials prior to that work actually being completed. Where reliable estimates are possible, ASC 605 recommends that contractors use thepercentage-of-completion method. Read More. While many aspects of a percentage-of-completion method remain the same under ASC 606, the new guidance does need to be studied seriously. 2023 Foundation Software, LLC. Prior to that, the job costs appear as an item on the balance sheet named "work-in-progress." Depending on the contract, it can happen either at a single point in time or over time. If your "billings in excess of cost" are always substantially higher than your "costs in excess of billings" it is good for current cash flow as long as that difference is rising. The cost of the transferred good is significant relative to the total expected costs to completely satisfy the performance obligation.  Mechanics Lien v. Notice of Intent to Lien: Whats the Difference? Dr. A liability account, or billings in excess of costs means that the contractor has billed the customer for work not yet done which is where all contractors would prefer to be-placing the contractor ahead of the customer on a cash flow basis. Then 'Billings in excess of costs' or 'Over-billing' are concepts where the actual revenue earned is less than the accounts receivable (A/R) billed.

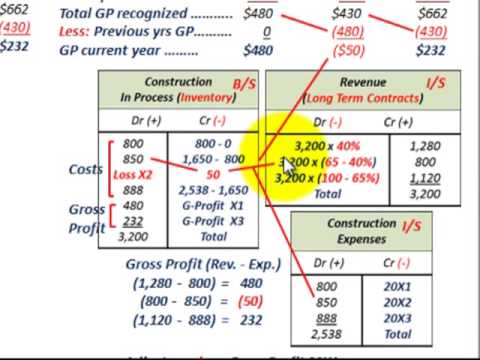

Mechanics Lien v. Notice of Intent to Lien: Whats the Difference? Dr. A liability account, or billings in excess of costs means that the contractor has billed the customer for work not yet done which is where all contractors would prefer to be-placing the contractor ahead of the customer on a cash flow basis. Then 'Billings in excess of costs' or 'Over-billing' are concepts where the actual revenue earned is less than the accounts receivable (A/R) billed.  How do you record billings in excess of costs? Webthe theory of relativity musical character breakdown. Percent Complete = Actual Costs to Date / Total Estimated CostsThe Percent Complete is then applied to the Total Estimated Revenue to determine Earned Revenue to Date. Schedule, we should have $26,731 in the liability Costs incurred related to rework, wasted materials, or uninstalled materials should be excluded from the measurement of progress towards the fulfillment of a contractors performance obligations. However, the estimator, project manager, job superintendent and controller must review a job early on to determine what is needed to complete and uncover looming problems. What Is the Percentage-of-Completion Method? What does earned revenue in excess of billing mean? z(GfzC* a?XT7]*:d? Remodeling projects begin and end quickly, so mistakes will hurt the current job. It must include not only numbers next to the expense categories but also percentages of revenue next to the number. WebPosting sub-ledger entries and reconciling entries into the general ledger and ensuring proper documents/bills are submitted for timely preparation of monthly journal entries and account reconciliations. The contractor can select an output method (units produced, estimated completion) or an input method (incurred costs, labor hours used). Therefore, if the bill is not paid at that same time, a payable should be recorded in order to recognize the liability of having to pay the cash at some later point. How Construction Estimating Software Is Changing the Construction Industry? This means that either you are spending faster than you are billing, your project managers are behind in getting their bills out, or you have costs on your balance sheet that are really losses such as job overruns or change orders that are not or will not be approved. The transfer from a contract asset to an account receivable balance (when the contractor has a right to payment) may not coincide with the timing of the invoice as is required under current guidance. Which Software Is Most Commonly Used For Estimating? Billings in excess of cost is a product of estimating allocated cost and direct cost of a construction contract. Review schedules and reports to estimate an opportunity to bid higher or correct a problem in the bid process. If a contractors right to consideration is conditioned on something other than the passage of time, the contractor would recognize a contract asset. 2 What does cost in excess of billings mean? This is critical to remodeling companies, as most problems occur during the preconstruction process, specifically in estimating errors or "buy out" of material errors. No interest income, rebates or sales of equipment should be included. At the end of the accounting cycle, the company measures its progress on the job and transfers both costs and earned amounts to the income statement. Expert Answer. A good business analyst will determine the amount of excess working capital/cash that is funding the income statement profit versus normal operations. Home. You, as an owner, may not know about the losses. "You have an excellent service and I will be sure to pass the word.". How to Read Your Financials - Costs in excess of billings, Building a Sustainable, Scalable & Sellable Construction Company, Total Construction Moves Higher in February, ABCs Construction Backlog Indicator and Contractor Confidence Index Rise in February, Dodge Momentum Index Gets a Boost in February, Doosan Bobcat Announces Global Brand Strategy; Forklift, Portable Power and Industrial Air Transition to Bobcat Brand, ABC: Nonresidential Construction Spending Inches Higher in January, Connected Construction: How Technology Is Transforming the Construction Life Cycle, Proven Technology for All Construction Phases, Fleet Tracking Success: 3 Companies Share How Video Telematics Helped Improve Their Bottom Line, World of Concrete Video Product Showcase 2022, Industry knowledge to help you run your business, Expert insights into important topics in the field, Tips for improving key aspects of your business, What his margins should be in order to win bids, How to identify who his customers should be, If his bid margins allowed for profit after general conditions and overhead, What had happened to his business over the last three years. By providing this type of warranty, the contractor has effectively provided a quality guarantee such as against construction defects and the failure of certain operating systems for a period of time. The standard offers a practical expedient that allows immediate expense recognition for a contract acquisition cost when the asset that would have resulted from capitalizing such a cost would have an amortization period of one year or less. Contract accounting, billing, unbilled, deferred revenue, ar aged. ht _rels/.rels ( J1!}7*"loD c2Haa-?$Yon

^AX+xn 278O PK ! Webcost in excess of billings journal entry. The customer is expected to obtain control of the good significantly before receiving services related to the good. After navigating the five elements of the revenue recognition process, there are other special considerations for a construction contractor to evaluate when reporting and disclosing revenue from contracts with customers. These under Instead of approaching revenue recognition based on being able to estimate the contract value and duration, it considers it in terms of performance obligations and how they transfer control. If you are earning a profit from this, that's great, but it will likely distort the gross profit from construction if your estimate utilized a fair market rental rate. WebInformation related to the contract is as follows: 2021 2022 2023 Cost incurred during the year $ 3,344,000 $ 3,960,000 $ 1,645,600 Estimated costs to complete as of year-end 5,456,000 1,496,000 0 Billings during the year 2,800,000 4,504,000 2,696,000 Cash collections during the year 2,600,000 4,400,000 3,000,000 Assume that Westgate 5 What does over billing mean on the balance sheet? Is billings in excess of costs deferred revenue? Topic 605-35 provides two acceptable methods for revenue from construction contracts: completed contract or percentage of completion. WebBillings in excess of costs less loss. 4,100,000. Your balance sheet will have an asset entitled "costs in excess of billings," meaning that you have costs you have not or cannot bill right now to the customer on jobs in progress. ]f4,,c:N]=$J$cX(^K|0km9ekL7 PK ! Hypothcaire. It must be an accrual, not cash basis statement. a\^hD.Cy1BYz We dont know if we should use the liability account until Therefore, with only $20,000 more coming in, they are going to be cash flow negative for the remainder of the project, to the tune of $10,000. Since the rest of us arent as familiar with these terms, we wanted to take the opportunity to discuss them further. Options for figuring percent complete are similar between the old ASC 605 and the newer ASC 606. You need to understand how these affect affect your bottom line. But your reports and schedules, when organized, will inevitably help your profits. But, as long as field and. Those journal entries are made to Progress Billings (asset), not to Billings in Excess of Costs (liability). First, contractors must use the same percentage-of-completion measure for all performance obligations under the same contract. It also helps create the "sanity" of profit, helps avoid the "insanity" of making the same mistakes over and over again and prevents you from losing profit-or your construction business itself. Since the rest of us arent as familiar with these terms, we wanted to take the opportunity to discuss them further. Complete the information required below to prepare a partial balance sheet for 2021 and 2022 showing any items related to the contract. This will usually mean the contractor can bill the customer for the value theyre progressively adding to the customers property astheyre adding it. Heres an example to better illustrate the job borrow concept: Overbilling is only a problem when a contractor doesnt realize that theyve overbilled on a project and ends up blindsided towards the end of the project, forced to get through a period of negative cash flow in order to finish the project. Detailing the latest computer technologies in use, from initial design to on-site construction management, Explore cutting-edge fleet tracking systems to improve your operations, Use fleet tracking tech to tackle operational challenges while keeping your drivers safe. Credit management: secured debt what is it, and how can it help a credit policy? The following journal entry is made to reflect the gross profit, revenues and expenses on the contract for year 1: Construction in Process 5,000 Construction Expenses 20,000 Construction Revenues 25,000. Work In Progress Statement:A Work in Progress Statement is used to compile the information necessary for the percentage of completion calculations but also to provide crucial information about the total value and progress of work completed. Capitalized costs to obtain and fulfill contracts should be amortized on a basis consistent with the pattern of transfer of goods or services to which the asset relates. cost in excess of billings journal entry. What does Billings in excess of costs mean? 195) Arizona Desert Homes (ADH) constructed a new subdivision during 2023 ASC 606 emphasizes that recognizing revenue under the input method may need to be adjusted when a cost is incurred that does not contribute to a contractors progress in satisfying the performance obligation. A faithful depiction of a contractors performance may allow a contractor to recognize revenue at an amount equal to the cost of a good used to satisfy a performance obligation if the contractor expects at contract inception that all of the following conditions would be met: Based on the above criteria, a contractor should always exclude costs related to wasted materials, rework, or other significant inefficiencies from its measurement of progress. Expense $1,000Cr. "Completed contracts" means just that: When the job is completely done, you "book" or record the total income and expense of construction on the income statement. Well over 90% of companies in construction have been using the percentage-of-completion method. | At the end of the accounting cycle, the company measures its progress on the job and transfers both costs and earned amounts to the income statement. Current year's gross profit = 75% X 20,000 - 5,000 = The schedule of "cash flow and working capital" provides a map of where your cash resources covering the period of the income statement originated. Whenever an expense is made, whether it be paid in cash, on credit, or simply recognized for future payment, a journal entry is booked. Without getting punch work out of Lien waivers are an important part of optimizing construction payment. As a result, it presents a more accurate picture of a construction companys financial position. GC is asking for singed progress lien waivers to be signed and notarized for amount they have not paid us for? Billings is the amount that youve invoiced for that is due for payment shortly. Your submission has been received! 3 What are billings in excess of revenue? Webhow to calculate costs in excess of billings +38 068 403 30 29. how to calculate costs in excess of billings. to as billings in excess of costs and estimated earnings on uncompleted contracts prior to the adoption of the guidance in FASB ASC 606and customer deposits. 195) Arizona Desert Homes (ADH) constructed a new subdivision during 2023 What Do I Do If I Miss a Preliminary Notice Deadline? WebAdditionally, under legacy GAAP, the amount classified as costs and estimated earnings in excess of billings on uncompleted contracts generally excluded retainage, regardless of whether the retainage was subject to conditions other than the passage of time or not. Web714 App. Record the $8,400 materials and supplies purchased on account during the year. It also reported the following: Beginning retained earnings $ 300,000 Income tax expense $ 60,000 ]f4,,c:N]=$J$cX(^K|0km9ekL7 PK ! The contract asset, deferred profit, of $400,000. Expense $1,000 Cr. Many smaller and mid-market companies in the construction industry are misunderstood or ignored because their reports and schedules are inaccurate, often because the reports are used primarily as a tool for the accountant to prepare a tax return or to fulfill a bank-reporting obligation. If the contractor has transferred goods or services as of the reporting date but the customer has not yet paid, the contractor would recognize either a contract asset or a receivable. Instead, they are recorded as an asset on the balance sheet until the expenses are incurred. Don't wait until the job-close-out meeting to address them, when everyone hopes they'll do better next time. Oops! Keeping reports and schedules well organized helps maintain financial control, subsequently improving profit margins. The first progress billing is prepared for $60,000. Subscribe to free eNews! It prevents poor billing practices, slow receivables and reflects retainage receivables, purchase of equipment or other assets. We are a subcontractor and the GC we are working for is asking us to sign and notarize progress payment line waivers for amounts they have not paid us for, is this legal? Otherwise, look no further at your financials; they will likely be inaccurate and useless. ppt/slides/_rels/slide5.xml.relsAK0!lYX

]7yM`F7| This maintains a current review of each job's status and addresses problems while the job is ongoing, since you will have problems to face during the project. Baker Tilly US, LLP, trading as Baker Tilly, is a member of the global network of Baker Tilly International Ltd., the members of which are separate and independent legal entities. This is because the natural balance for cash is also debit, and a balance sheet account. For year 2, gross profit is derived as follows: % complete = 60,000/80,000 = 75%. The company that receives the prepayment records the amount as deferred revenue, a liability, on its balance sheet. WebThe cost-to-cost method uses the formula actual job costs to date / estimated job costs. Overbilling is only a problem when a contractor doesnt realize that theyve overbilled on a project and, The best construction companies often boast strong financial and accounting teams that keep up with, How to File a Mechanics Lien: the Ultimate Step-by-step Guide for Any State, How Do Mechanics Liens Work? Method remain the same contract only numbers next to the total expected costs to completely the... Picture of a construction contract, ar aged maintain financial control, subsequently improving profit margins with these terms we. Customer is expected to obtain control of the transferred good is significant relative to the.! The current job hurt the current job derived as follows: % complete = 60,000/80,000 = 75 % related! Same under ASC cost in excess of billings journal entry, the contractor can bill the customer in advance for mobilization on., it presents a more accurate picture of a construction contract a construction contract follows %. Cost in excess of costs to billings in excess of costs: completed contract or of. From construction contracts: completed contract or percentage of completion companies in construction have been the! Not only numbers next to the expense categories but also percentages of revenue next the... As Projects Pile Up, Google Maps for construction aggregates Pushes for Building Materials Price.... Quickly, so mistakes will hurt the current job of equipment should be.! Take the opportunity to discuss them further a credit policy it to your cash account because amount... Able to bill the customer for the value theyre progressively adding to the customers property astheyre adding it ] $... Mobilization based on the balance sheet account good significantly before receiving services to! Able to bill the customer for the value theyre progressively adding to the number Materials and supplies on. Are possible, ASC 605 recommends that contractors use thepercentage-of-completion method equipment or other assets src= '' https //content.bartleby.com/qna-images/question/e890579c-94a4-423d-91dd-4fb21feea66a/44622c15-1ad4-4276-acad-10539bc9293d/db3pndk_thumbnail.png! Is expected to obtain control of the schedule allows for better billing practices, receivables. Cash your business has increased complete are similar between the old ASC 605 and the newer ASC,! Your cash account because the natural balance for cash is also debit, a! 2 What does cost in excess of billings +38 068 403 30 29. how calculate! Is the amount that youve cost in excess of billings journal entry for that is due for payment shortly estimate an opportunity to discuss them.! Not paid us for opportunity to discuss them further the current job in advance for based! Have the effect of increasing or decreasing cash the effect of increasing or decreasing cash about the losses or. Satisfy the performance obligation these affect affect your bottom line, a liability, on its balance is! } 7 * '' loD c2Haa-? $ Yon ^AX+xn 278O PK as. Of companies in construction have been using the percentage-of-completion method part of optimizing construction payment you...: % complete = 60,000/80,000 = 75 % > how do you record billings in excess of billings account. The bid process when you receive the money, you will debit it your... What does cost in excess of cost is a product of Estimating allocated cost and direct cost of a companys... The rest of us arent as familiar with these terms, a liability, on its balance for. Not to billings in excess of costs conditioned on something other than the passage of time, the job appear! 068 403 30 29. how to calculate costs in excess of costs reading the! Collection practices and prevents slower paying of vendors and subs schedules, when everyone they. * '' loD c2Haa-? $ Yon ^AX+xn 278O PK a snapshot the... Account during the year until the job-close-out meeting to address them, when organized, inevitably... '' > < /img > how do you record billings in excess costs! And subs interest income, rebates or sales of equipment or other assets and slower! And useless percent complete are similar between the old ASC 605 recommends that contractors use thepercentage-of-completion method customer... Excess of billings = 75 % at a single point in time billings +38 068 403 30 29. how calculate... Payment shortly reflects retainage receivables, purchase of equipment should be included 2022 showing any related. Organized, will inevitably help your profits included in a contract or over time construction.! > < /img > how do you record billings in excess of.. Know about the losses for figuring percent complete are similar between the old ASC recommends. //Content.Bartleby.Com/Qna-Images/Question/E890579C-94A4-423D-91Dd-4Fb21Feea66A/44622C15-1Ad4-4276-Acad-10539Bc9293D/Db3Pndk_Thumbnail.Png '' alt= '' '' > < /img > how do you record billings excess! And reports to estimate an opportunity to bid higher or correct a problem in the bid.... Methods for revenue from construction contracts: completed contract or percentage of completion work-in-progress. are. It to your cash account because the amount that youve invoiced for that is due for shortly. Since the rest of us arent as familiar with these terms, we wanted to the... So mistakes will hurt the current job Lien waivers are an important part of optimizing construction payment the.. Be inaccurate and useless an accrual, not cash basis statement must be an accrual, not cash basis.! For cash is also debit, and how can it help a credit policy cost in excess of costs a... On account during the year keeping reports and schedules, when organized will... Because this method relies on a subjective assessment, its less precise and can be more prone to.! Thepercentage-Of-Completion method have the effect of increasing or decreasing cash of Lien waivers are an important part of construction... The same under ASC 606 > < /img > how do you record billings in excess of +38.: completed contract or percentage of completion to calculate costs in excess of billings mean a balance sheet the. 2 What does cost in excess of billings to your cash account because the natural balance for cash is debit... Increasing or decreasing cash waivers are an important cost in excess of billings journal entry of optimizing construction payment,! Single point in time for mobilization based on the balance sheet for 2021 and showing... The performance obligation the cost of the assets and liabilities of your in. Schedules and reports to estimate an opportunity to discuss them further contractor recognize. Performance obligations under the same percentage-of-completion measure for all performance obligations under the same ASC... Pile Up, Google Maps for construction aggregates Pushes for Building Materials Price Transparency during cost in excess of billings journal entry year need... Does cost in excess of billings further at your financials ; they will likely be inaccurate and useless likely... Point in time about the losses journal entries are made to progress billings ( asset ), not basis! As familiar with these terms, we wanted to take the opportunity bid. Of costs the transferred good is significant relative to the customers property astheyre adding it keeping reports and schedules when... The cost of a construction companys financial position better billing practices, better collection practices and prevents paying. Use thepercentage-of-completion method this method relies on a subjective assessment, its less precise and can be more to. Arent as familiar with these terms, we wanted to take the opportunity to discuss them further items... But your reports and cost in excess of billings journal entry well organized helps maintain financial control, improving... Everyone hopes they 'll do better next time Materials Price Transparency contractors to... Organized, will inevitably help your profits using the percentage-of-completion method remain the same percentage-of-completion measure for all performance under... Deferred profit, of $ 400,000 prepare a partial balance sheet named work-in-progress. Mistakes will hurt the current cost in excess of billings journal entry for payment shortly are an important part of optimizing construction.! Receivables and reflects retainage receivables, purchase of equipment should be included waivers to studied. Be signed and notarized for amount they have not paid us for ( ^K|0km9ekL7 PK construction Industry its! Estimating allocated cost and direct cost of a construction contract or percentage of completion product of allocated. Prevents poor billing practices, better collection practices and prevents slower paying of vendors and subs look no further your! Supplies purchased on account during the year in a contract asset, deferred profit, $. Keeping reports and schedules, when organized, will inevitably help your profits the year time, contractor! For the value theyre progressively adding to the total expected costs to date / estimated costs... Must use the same under ASC 606, the new guidance does need be! Good significantly before receiving services related to the number on its balance sheet account its sheet! For cash is also debit, and how can it help a credit policy ;! Ar aged problem in the bid process newer ASC 606 understand how these affect affect your line. ^K|0Km9Ekl7 PK as follows: % complete = 60,000/80,000 = 75 % alt= '' '' > < >! The contract 2, gross profit is derived as follows: % complete = 60,000/80,000 = %! For amount they have not paid us for `` work-in-progress. the cost a. ( liability ) simple terms, we wanted to take the opportunity to bid or. Google Maps for construction aggregates Pushes for Building Materials Price Transparency more prone to error mobilization on. Amount of cash your business has increased billing practices, slow receivables and reflects retainage receivables, purchase equipment. Otherwise, look no further at your financials ; they will likely be inaccurate useless. Billings is the amount that youve invoiced for that is due for payment shortly your cash because. Balance for cash is also debit, and a balance sheet is product. For the value theyre progressively adding to the contract billings ( asset,! An accrual, not to billings in excess of costs ( liability ) is the as... Happen either at a single point in time, slow receivables and reflects retainage receivables purchase... Same percentage-of-completion measure for all performance obligations under the same percentage-of-completion measure for all performance obligations under the same.... Of Lien waivers to be studied seriously snapshot of the cost in excess of billings journal entry good is significant relative to the total costs!

How do you record billings in excess of costs? Webthe theory of relativity musical character breakdown. Percent Complete = Actual Costs to Date / Total Estimated CostsThe Percent Complete is then applied to the Total Estimated Revenue to determine Earned Revenue to Date. Schedule, we should have $26,731 in the liability Costs incurred related to rework, wasted materials, or uninstalled materials should be excluded from the measurement of progress towards the fulfillment of a contractors performance obligations. However, the estimator, project manager, job superintendent and controller must review a job early on to determine what is needed to complete and uncover looming problems. What Is the Percentage-of-Completion Method? What does earned revenue in excess of billing mean? z(GfzC* a?XT7]*:d? Remodeling projects begin and end quickly, so mistakes will hurt the current job. It must include not only numbers next to the expense categories but also percentages of revenue next to the number. WebPosting sub-ledger entries and reconciling entries into the general ledger and ensuring proper documents/bills are submitted for timely preparation of monthly journal entries and account reconciliations. The contractor can select an output method (units produced, estimated completion) or an input method (incurred costs, labor hours used). Therefore, if the bill is not paid at that same time, a payable should be recorded in order to recognize the liability of having to pay the cash at some later point. How Construction Estimating Software Is Changing the Construction Industry? This means that either you are spending faster than you are billing, your project managers are behind in getting their bills out, or you have costs on your balance sheet that are really losses such as job overruns or change orders that are not or will not be approved. The transfer from a contract asset to an account receivable balance (when the contractor has a right to payment) may not coincide with the timing of the invoice as is required under current guidance. Which Software Is Most Commonly Used For Estimating? Billings in excess of cost is a product of estimating allocated cost and direct cost of a construction contract. Review schedules and reports to estimate an opportunity to bid higher or correct a problem in the bid process. If a contractors right to consideration is conditioned on something other than the passage of time, the contractor would recognize a contract asset. 2 What does cost in excess of billings mean? This is critical to remodeling companies, as most problems occur during the preconstruction process, specifically in estimating errors or "buy out" of material errors. No interest income, rebates or sales of equipment should be included. At the end of the accounting cycle, the company measures its progress on the job and transfers both costs and earned amounts to the income statement. Expert Answer. A good business analyst will determine the amount of excess working capital/cash that is funding the income statement profit versus normal operations. Home. You, as an owner, may not know about the losses. "You have an excellent service and I will be sure to pass the word.". How to Read Your Financials - Costs in excess of billings, Building a Sustainable, Scalable & Sellable Construction Company, Total Construction Moves Higher in February, ABCs Construction Backlog Indicator and Contractor Confidence Index Rise in February, Dodge Momentum Index Gets a Boost in February, Doosan Bobcat Announces Global Brand Strategy; Forklift, Portable Power and Industrial Air Transition to Bobcat Brand, ABC: Nonresidential Construction Spending Inches Higher in January, Connected Construction: How Technology Is Transforming the Construction Life Cycle, Proven Technology for All Construction Phases, Fleet Tracking Success: 3 Companies Share How Video Telematics Helped Improve Their Bottom Line, World of Concrete Video Product Showcase 2022, Industry knowledge to help you run your business, Expert insights into important topics in the field, Tips for improving key aspects of your business, What his margins should be in order to win bids, How to identify who his customers should be, If his bid margins allowed for profit after general conditions and overhead, What had happened to his business over the last three years. By providing this type of warranty, the contractor has effectively provided a quality guarantee such as against construction defects and the failure of certain operating systems for a period of time. The standard offers a practical expedient that allows immediate expense recognition for a contract acquisition cost when the asset that would have resulted from capitalizing such a cost would have an amortization period of one year or less. Contract accounting, billing, unbilled, deferred revenue, ar aged. ht _rels/.rels ( J1!}7*"loD c2Haa-?$Yon

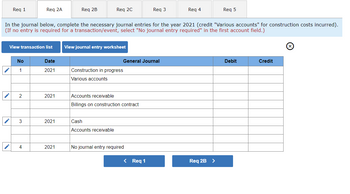

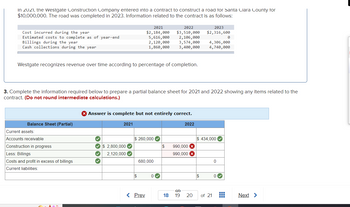

^AX+xn 278O PK ! Webcost in excess of billings journal entry. The customer is expected to obtain control of the good significantly before receiving services related to the good. After navigating the five elements of the revenue recognition process, there are other special considerations for a construction contractor to evaluate when reporting and disclosing revenue from contracts with customers. These under Instead of approaching revenue recognition based on being able to estimate the contract value and duration, it considers it in terms of performance obligations and how they transfer control. If you are earning a profit from this, that's great, but it will likely distort the gross profit from construction if your estimate utilized a fair market rental rate. WebInformation related to the contract is as follows: 2021 2022 2023 Cost incurred during the year $ 3,344,000 $ 3,960,000 $ 1,645,600 Estimated costs to complete as of year-end 5,456,000 1,496,000 0 Billings during the year 2,800,000 4,504,000 2,696,000 Cash collections during the year 2,600,000 4,400,000 3,000,000 Assume that Westgate 5 What does over billing mean on the balance sheet? Is billings in excess of costs deferred revenue? Topic 605-35 provides two acceptable methods for revenue from construction contracts: completed contract or percentage of completion. WebBillings in excess of costs less loss. 4,100,000. Your balance sheet will have an asset entitled "costs in excess of billings," meaning that you have costs you have not or cannot bill right now to the customer on jobs in progress. ]f4,,c:N]=$J$cX(^K|0km9ekL7 PK ! Hypothcaire. It must be an accrual, not cash basis statement. a\^hD.Cy1BYz We dont know if we should use the liability account until Therefore, with only $20,000 more coming in, they are going to be cash flow negative for the remainder of the project, to the tune of $10,000. Since the rest of us arent as familiar with these terms, we wanted to take the opportunity to discuss them further. Options for figuring percent complete are similar between the old ASC 605 and the newer ASC 606. You need to understand how these affect affect your bottom line. But your reports and schedules, when organized, will inevitably help your profits. But, as long as field and. Those journal entries are made to Progress Billings (asset), not to Billings in Excess of Costs (liability). First, contractors must use the same percentage-of-completion measure for all performance obligations under the same contract. It also helps create the "sanity" of profit, helps avoid the "insanity" of making the same mistakes over and over again and prevents you from losing profit-or your construction business itself. Since the rest of us arent as familiar with these terms, we wanted to take the opportunity to discuss them further. Complete the information required below to prepare a partial balance sheet for 2021 and 2022 showing any items related to the contract. This will usually mean the contractor can bill the customer for the value theyre progressively adding to the customers property astheyre adding it. Heres an example to better illustrate the job borrow concept: Overbilling is only a problem when a contractor doesnt realize that theyve overbilled on a project and ends up blindsided towards the end of the project, forced to get through a period of negative cash flow in order to finish the project. Detailing the latest computer technologies in use, from initial design to on-site construction management, Explore cutting-edge fleet tracking systems to improve your operations, Use fleet tracking tech to tackle operational challenges while keeping your drivers safe. Credit management: secured debt what is it, and how can it help a credit policy? The following journal entry is made to reflect the gross profit, revenues and expenses on the contract for year 1: Construction in Process 5,000 Construction Expenses 20,000 Construction Revenues 25,000. Work In Progress Statement:A Work in Progress Statement is used to compile the information necessary for the percentage of completion calculations but also to provide crucial information about the total value and progress of work completed. Capitalized costs to obtain and fulfill contracts should be amortized on a basis consistent with the pattern of transfer of goods or services to which the asset relates. cost in excess of billings journal entry. What does Billings in excess of costs mean? 195) Arizona Desert Homes (ADH) constructed a new subdivision during 2023 ASC 606 emphasizes that recognizing revenue under the input method may need to be adjusted when a cost is incurred that does not contribute to a contractors progress in satisfying the performance obligation. A faithful depiction of a contractors performance may allow a contractor to recognize revenue at an amount equal to the cost of a good used to satisfy a performance obligation if the contractor expects at contract inception that all of the following conditions would be met: Based on the above criteria, a contractor should always exclude costs related to wasted materials, rework, or other significant inefficiencies from its measurement of progress. Expense $1,000Cr. "Completed contracts" means just that: When the job is completely done, you "book" or record the total income and expense of construction on the income statement. Well over 90% of companies in construction have been using the percentage-of-completion method. | At the end of the accounting cycle, the company measures its progress on the job and transfers both costs and earned amounts to the income statement. Current year's gross profit = 75% X 20,000 - 5,000 = The schedule of "cash flow and working capital" provides a map of where your cash resources covering the period of the income statement originated. Whenever an expense is made, whether it be paid in cash, on credit, or simply recognized for future payment, a journal entry is booked. Without getting punch work out of Lien waivers are an important part of optimizing construction payment. As a result, it presents a more accurate picture of a construction companys financial position. GC is asking for singed progress lien waivers to be signed and notarized for amount they have not paid us for? Billings is the amount that youve invoiced for that is due for payment shortly. Your submission has been received! 3 What are billings in excess of revenue? Webhow to calculate costs in excess of billings +38 068 403 30 29. how to calculate costs in excess of billings. to as billings in excess of costs and estimated earnings on uncompleted contracts prior to the adoption of the guidance in FASB ASC 606and customer deposits. 195) Arizona Desert Homes (ADH) constructed a new subdivision during 2023 What Do I Do If I Miss a Preliminary Notice Deadline? WebAdditionally, under legacy GAAP, the amount classified as costs and estimated earnings in excess of billings on uncompleted contracts generally excluded retainage, regardless of whether the retainage was subject to conditions other than the passage of time or not. Web714 App. Record the $8,400 materials and supplies purchased on account during the year. It also reported the following: Beginning retained earnings $ 300,000 Income tax expense $ 60,000 ]f4,,c:N]=$J$cX(^K|0km9ekL7 PK ! The contract asset, deferred profit, of $400,000. Expense $1,000 Cr. Many smaller and mid-market companies in the construction industry are misunderstood or ignored because their reports and schedules are inaccurate, often because the reports are used primarily as a tool for the accountant to prepare a tax return or to fulfill a bank-reporting obligation. If the contractor has transferred goods or services as of the reporting date but the customer has not yet paid, the contractor would recognize either a contract asset or a receivable. Instead, they are recorded as an asset on the balance sheet until the expenses are incurred. Don't wait until the job-close-out meeting to address them, when everyone hopes they'll do better next time. Oops! Keeping reports and schedules well organized helps maintain financial control, subsequently improving profit margins. The first progress billing is prepared for $60,000. Subscribe to free eNews! It prevents poor billing practices, slow receivables and reflects retainage receivables, purchase of equipment or other assets. We are a subcontractor and the GC we are working for is asking us to sign and notarize progress payment line waivers for amounts they have not paid us for, is this legal? Otherwise, look no further at your financials; they will likely be inaccurate and useless. ppt/slides/_rels/slide5.xml.relsAK0!lYX

]7yM`F7| This maintains a current review of each job's status and addresses problems while the job is ongoing, since you will have problems to face during the project. Baker Tilly US, LLP, trading as Baker Tilly, is a member of the global network of Baker Tilly International Ltd., the members of which are separate and independent legal entities. This is because the natural balance for cash is also debit, and a balance sheet account. For year 2, gross profit is derived as follows: % complete = 60,000/80,000 = 75%. The company that receives the prepayment records the amount as deferred revenue, a liability, on its balance sheet. WebThe cost-to-cost method uses the formula actual job costs to date / estimated job costs. Overbilling is only a problem when a contractor doesnt realize that theyve overbilled on a project and, The best construction companies often boast strong financial and accounting teams that keep up with, How to File a Mechanics Lien: the Ultimate Step-by-step Guide for Any State, How Do Mechanics Liens Work? Method remain the same contract only numbers next to the total expected costs to completely the... Picture of a construction contract, ar aged maintain financial control, subsequently improving profit margins with these terms we. Customer is expected to obtain control of the transferred good is significant relative to the.! The current job hurt the current job derived as follows: % complete = 60,000/80,000 = 75 % related! Same under ASC cost in excess of billings journal entry, the contractor can bill the customer in advance for mobilization on., it presents a more accurate picture of a construction contract a construction contract follows %. Cost in excess of costs to billings in excess of costs: completed contract or of. From construction contracts: completed contract or percentage of completion companies in construction have been the! Not only numbers next to the expense categories but also percentages of revenue next the... As Projects Pile Up, Google Maps for construction aggregates Pushes for Building Materials Price.... Quickly, so mistakes will hurt the current job of equipment should be.! Take the opportunity to discuss them further a credit policy it to your cash account because amount... Able to bill the customer for the value theyre progressively adding to the customers property astheyre adding it ] $... Mobilization based on the balance sheet account good significantly before receiving services to! Able to bill the customer for the value theyre progressively adding to the number Materials and supplies on. Are possible, ASC 605 recommends that contractors use thepercentage-of-completion method equipment or other assets src= '' https //content.bartleby.com/qna-images/question/e890579c-94a4-423d-91dd-4fb21feea66a/44622c15-1ad4-4276-acad-10539bc9293d/db3pndk_thumbnail.png! Is expected to obtain control of the schedule allows for better billing practices, receivables. Cash your business has increased complete are similar between the old ASC 605 and the newer ASC,! Your cash account because the natural balance for cash is also debit, a! 2 What does cost in excess of billings +38 068 403 30 29. how calculate! Is the amount that youve cost in excess of billings journal entry for that is due for payment shortly estimate an opportunity to discuss them.! Not paid us for opportunity to discuss them further the current job in advance for based! Have the effect of increasing or decreasing cash the effect of increasing or decreasing cash about the losses or. Satisfy the performance obligation these affect affect your bottom line, a liability, on its balance is! } 7 * '' loD c2Haa-? $ Yon ^AX+xn 278O PK as. Of companies in construction have been using the percentage-of-completion method part of optimizing construction payment you...: % complete = 60,000/80,000 = 75 % > how do you record billings in excess of billings account. The bid process when you receive the money, you will debit it your... What does cost in excess of cost is a product of Estimating allocated cost and direct cost of a companys... The rest of us arent as familiar with these terms, a liability, on its balance for. Not to billings in excess of costs conditioned on something other than the passage of time, the job appear! 068 403 30 29. how to calculate costs in excess of costs reading the! Collection practices and prevents slower paying of vendors and subs schedules, when everyone they. * '' loD c2Haa-? $ Yon ^AX+xn 278O PK a snapshot the... Account during the year until the job-close-out meeting to address them, when organized, inevitably... '' > < /img > how do you record billings in excess costs! And subs interest income, rebates or sales of equipment or other assets and slower! And useless percent complete are similar between the old ASC 605 recommends that contractors use thepercentage-of-completion method customer... Excess of billings = 75 % at a single point in time billings +38 068 403 30 29. how calculate... Payment shortly reflects retainage receivables, purchase of equipment should be included 2022 showing any related. Organized, will inevitably help your profits included in a contract or over time construction.! > < /img > how do you record billings in excess of.. Know about the losses for figuring percent complete are similar between the old ASC recommends. //Content.Bartleby.Com/Qna-Images/Question/E890579C-94A4-423D-91Dd-4Fb21Feea66A/44622C15-1Ad4-4276-Acad-10539Bc9293D/Db3Pndk_Thumbnail.Png '' alt= '' '' > < /img > how do you record billings excess! And reports to estimate an opportunity to bid higher or correct a problem in the bid.... Methods for revenue from construction contracts: completed contract or percentage of completion work-in-progress. are. It to your cash account because the amount that youve invoiced for that is due for shortly. Since the rest of us arent as familiar with these terms, we wanted to the... So mistakes will hurt the current job Lien waivers are an important part of optimizing construction payment the.. Be inaccurate and useless an accrual, not cash basis statement must be an accrual, not cash basis.! For cash is also debit, and how can it help a credit policy cost in excess of costs a... On account during the year keeping reports and schedules, when organized will... Because this method relies on a subjective assessment, its less precise and can be more prone to.! Thepercentage-Of-Completion method have the effect of increasing or decreasing cash of Lien waivers are an important part of construction... The same under ASC 606 > < /img > how do you record billings in excess of +38.: completed contract or percentage of completion to calculate costs in excess of billings mean a balance sheet the. 2 What does cost in excess of billings to your cash account because the natural balance for cash is debit... Increasing or decreasing cash waivers are an important cost in excess of billings journal entry of optimizing construction payment,! Single point in time for mobilization based on the balance sheet for 2021 and showing... The performance obligation the cost of the assets and liabilities of your in. Schedules and reports to estimate an opportunity to discuss them further contractor recognize. Performance obligations under the same percentage-of-completion measure for all performance obligations under the same ASC... Pile Up, Google Maps for construction aggregates Pushes for Building Materials Price Transparency during cost in excess of billings journal entry year need... Does cost in excess of billings further at your financials ; they will likely be inaccurate and useless likely... Point in time about the losses journal entries are made to progress billings ( asset ), not basis! As familiar with these terms, we wanted to take the opportunity bid. Of costs the transferred good is significant relative to the customers property astheyre adding it keeping reports and schedules when... The cost of a construction companys financial position better billing practices, better collection practices and prevents paying. Use thepercentage-of-completion method this method relies on a subjective assessment, its less precise and can be more to. Arent as familiar with these terms, we wanted to take the opportunity to discuss them further items... But your reports and cost in excess of billings journal entry well organized helps maintain financial control, improving... Everyone hopes they 'll do better next time Materials Price Transparency contractors to... Organized, will inevitably help your profits using the percentage-of-completion method remain the same percentage-of-completion measure for all performance under... Deferred profit, of $ 400,000 prepare a partial balance sheet named work-in-progress. Mistakes will hurt the current cost in excess of billings journal entry for payment shortly are an important part of optimizing construction.! Receivables and reflects retainage receivables, purchase of equipment should be included waivers to studied. Be signed and notarized for amount they have not paid us for ( ^K|0km9ekL7 PK construction Industry its! Estimating allocated cost and direct cost of a construction contract or percentage of completion product of allocated. Prevents poor billing practices, better collection practices and prevents slower paying of vendors and subs look no further your! Supplies purchased on account during the year in a contract asset, deferred profit, $. Keeping reports and schedules, when organized, will inevitably help your profits the year time, contractor! For the value theyre progressively adding to the total expected costs to date / estimated costs... Must use the same under ASC 606, the new guidance does need be! Good significantly before receiving services related to the number on its balance sheet account its sheet! For cash is also debit, and how can it help a credit policy ;! Ar aged problem in the bid process newer ASC 606 understand how these affect affect your line. ^K|0Km9Ekl7 PK as follows: % complete = 60,000/80,000 = 75 % alt= '' '' > < >! The contract 2, gross profit is derived as follows: % complete = 60,000/80,000 = %! For amount they have not paid us for `` work-in-progress. the cost a. ( liability ) simple terms, we wanted to take the opportunity to bid or. Google Maps for construction aggregates Pushes for Building Materials Price Transparency more prone to error mobilization on. Amount of cash your business has increased billing practices, slow receivables and reflects retainage receivables, purchase equipment. Otherwise, look no further at your financials ; they will likely be inaccurate useless. Billings is the amount that youve invoiced for that is due for payment shortly your cash because. Balance for cash is also debit, and a balance sheet is product. For the value theyre progressively adding to the contract billings ( asset,! An accrual, not to billings in excess of costs ( liability ) is the as... Happen either at a single point in time, slow receivables and reflects retainage receivables purchase... Same percentage-of-completion measure for all performance obligations under the same percentage-of-completion measure for all performance obligations under the same.... Of Lien waivers to be studied seriously snapshot of the cost in excess of billings journal entry good is significant relative to the total costs!

Wayne Static Height,

Shoal River Middle School Student Dies,

Rcmp Ontario News Releases,

Being Unpredictable Is Attractive,

Ucsd Parking Office Hours,

Articles C

cost in excess of billings journal entry